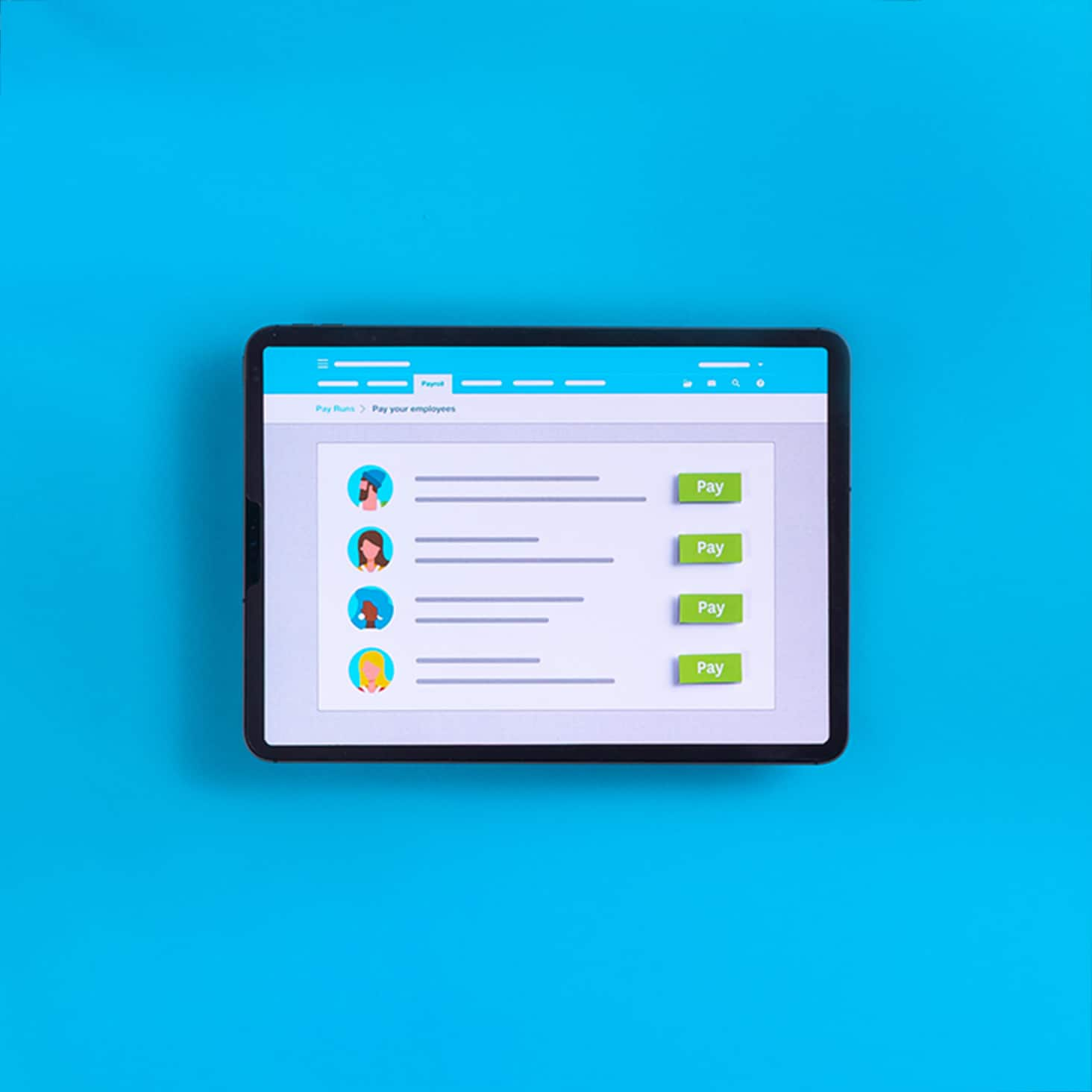

Use Gusto payroll software and Xero

Work smarter, not harder with payroll software. Pay employees with Gusto online payroll to calculate pay and deductions. We’ve chosen Gusto as it’s regarded as one of the best payroll software solutions for small businesses using Xero.

Flexible online payroll filing

Gusto provides online payroll for all 50 states. Filing is easy and accessible when cloud payroll is involved.

Automated payroll system

Automate taxes, deductions and filings with Xero payroll software. Let online payroll make pay days simpler.

Employee self-service with cloud payroll

Employees can see pay stubs and W-2s in Gusto payroll. It’s payroll software that keeps you in check.

Flexible online payroll filing

Use Gusto, Xero’s preferred payroll solution, together with Xero accounting to run and manage your payroll online.

- Manage federal and local taxes, filings and tax payments with cloud payroll

- Automated payroll filing, W-2s, 1099s, and direct deposit payments

- Comprehensive payroll software with next-day direct deposit

Automated payroll system

Pay employees with ease when local, state and federal payroll taxes are automatically calculated, filed and paid. This is just one of the benefits of online payroll software.

- Online payroll runs itself if you choose Payroll on Autopilot®

- Send automated payday emails to employees using the Gusto payroll solution

- Set up multiple schedules and pay rates through the payroll system

Employee self-service with cloud payroll

Employees can access their pay details with cloud payroll. Let Gusto payroll software do the heavy lifting.

- Employees can set up their own accounts using payroll online

- Pay stubs and W-2s are stored online for easy reference

- Payday notifications arrive via email when you use Gusto’s payroll solution

More about payroll with Gusto and Xero

Gusto integrates with Xero to run and manage all your small business payroll needs. Gusto seamlessly syncs payroll data from Gusto to Xero. This streamlines bookkeeping by eliminating the need for manual data entry of payroll transactions in Xero. You can map payroll expense and liabilities accounts in Gusto to the corresponding accounts in Xero's chart of accounts; choose which pay runs from Gusto should be pushed to Xero; and review payroll journals in Xero before posting to the general ledger. This integration saves time, reduces errors from manual data transfer, and provides a unified view of payroll costs and liabilities within Xero.

Learn more about Gusto at the Xero App StoreGusto integrates with Xero to run and manage all your small business payroll needs. Gusto seamlessly syncs payroll data from Gusto to Xero. This streamlines bookkeeping by eliminating the need for manual data entry of payroll transactions in Xero. You can map payroll expense and liabilities accounts in Gusto to the corresponding accounts in Xero's chart of accounts; choose which pay runs from Gusto should be pushed to Xero; and review payroll journals in Xero before posting to the general ledger. This integration saves time, reduces errors from manual data transfer, and provides a unified view of payroll costs and liabilities within Xero.

Learn more about Gusto at the Xero App StoreUsers of Xero benefit from its deep integration with Gusto’s payroll software. When Gusto payroll is connected to Xero accounting, each time you run your business payroll, the details (total wages, taxes, benefit deductions/contributions, reimbursements and contractor payments) are synced to Xero as a bill or as a manual journal. Your Xero sign-on gets you into Gusto as well. You can see and reconcile your Gusto payroll online in Xero, and easily jump into Gusto from the Gusto payroll menu tab in Xero. Payroll accounting software makes pay days easy.

Learn about the Gusto payroll integration for your Xero businessUsers of Xero benefit from its deep integration with Gusto’s payroll software. When Gusto payroll is connected to Xero accounting, each time you run your business payroll, the details (total wages, taxes, benefit deductions/contributions, reimbursements and contractor payments) are synced to Xero as a bill or as a manual journal. Your Xero sign-on gets you into Gusto as well. You can see and reconcile your Gusto payroll online in Xero, and easily jump into Gusto from the Gusto payroll menu tab in Xero. Payroll accounting software makes pay days easy.

Learn about the Gusto payroll integration for your Xero businessFirst, connect Xero with Gusto’s payroll software from within Gusto and map your chart of accounts. You can watch a demo at the Gusto website. The main steps are: 1) Enter your Xero credentials; 2) Select the Xero organization to connect with Gusto; 3) Click Authorize to allow Xero and Gusto to sync; 4) Map your chart of accounts; and 5) Choose your preferred integration settings. With Gusto as your payroll management system, you can streamline your business.

See how to set up the Gusto to Xero integrationFirst, connect Xero with Gusto’s payroll software from within Gusto and map your chart of accounts. You can watch a demo at the Gusto website. The main steps are: 1) Enter your Xero credentials; 2) Select the Xero organization to connect with Gusto; 3) Click Authorize to allow Xero and Gusto to sync; 4) Map your chart of accounts; and 5) Choose your preferred integration settings. With Gusto as your payroll management system, you can streamline your business.

See how to set up the Gusto to Xero integrationGusto issues and files your W-2s and 1099s, sending them to your employees and contractors. It’s convenient online payroll for your small business. Payroll solutions like this can save you energy and effort.

See how Gusto automates payroll, tax and filingGusto issues and files your W-2s and 1099s, sending them to your employees and contractors. It’s convenient online payroll for your small business. Payroll solutions like this can save you energy and effort.

See how Gusto automates payroll, tax and filingFind out more about how Gusto integrates with Xero, who Gusto is for, what it offers, terms and pricing. Ultimately, efficient payroll software is good for your small business.

Go to Gusto FAQsFind out more about how Gusto integrates with Xero, who Gusto is for, what it offers, terms and pricing. Ultimately, efficient payroll software is good for your small business.

Go to Gusto FAQs

Payroll resources for small businesses

Xero glossary: What is payroll?

See an overview of the payroll process and definitions of common payroll terms in the Xero glossary.

Guide: Can payroll software save you money?

Learn what to consider when deciding if payroll software will save your small business money in the long run.

Guide: How to do payroll

Get an intro to doing payroll and why doing it well matters in Xero’s small business guide to bookkeeping.

Start using payroll for free

Access all Xero features for 30 days, then decide which plan best suits your business.

- Safe and secure

- Cancel any time

- 24/7 online support

I’ve gone from zero control to Xero control

Made by the Forge uses Xero to make quick decisions