How to send an invoice

How you send invoices can have a big impact on how quickly you’re paid. Let’s look at some of the basics.

When to send an invoice

Some businesses send invoices every week or every two weeks. Some do it once a month. In fact, it's best to send your invoice as soon as an order is filled or the work is done – that way you don’t forget.

Schedule your invoicing to suit your cash flow. (Send interim invoices if necessary.) You want money to come in before you have to pay your bills. Whatever your schedule, make it clear to your customer as early as you can when they should expect it – put it on the payment terms when you quote.

How to write the invoice

Put all the relevant details on the invoice, including details of the buyer and seller, the products and services, prices and taxes (if applicable), and payment terms.

How to send the invoice

You have options when it comes to getting an invoice into your customer’s hands. Let’s look at the pros and cons of each.

In the mail

Mail can still be best for customers that overlook emailed invoices, or don’t use email at all. But compared to other methods, mail is slow, less secure, more expensive, and harder to get right as addresses often change.

By email

Email addresses are easier to get right and the invoices arrive faster. Plus the invoice can’t really be lost. Just double-check you’re sending it to the right person or department.

Via online invoicing

You can create an invoice online and send your customer a secure link to it. It’s nice and simple for them, and you can see when they’ve opened it. Better still, online invoices allow you to include a “Pay now” button. Customers just click through to pay immediately via credit card, debit card, or automated clearing houses like Stripe or GoCardless.

Learn more about how to send an invoice.

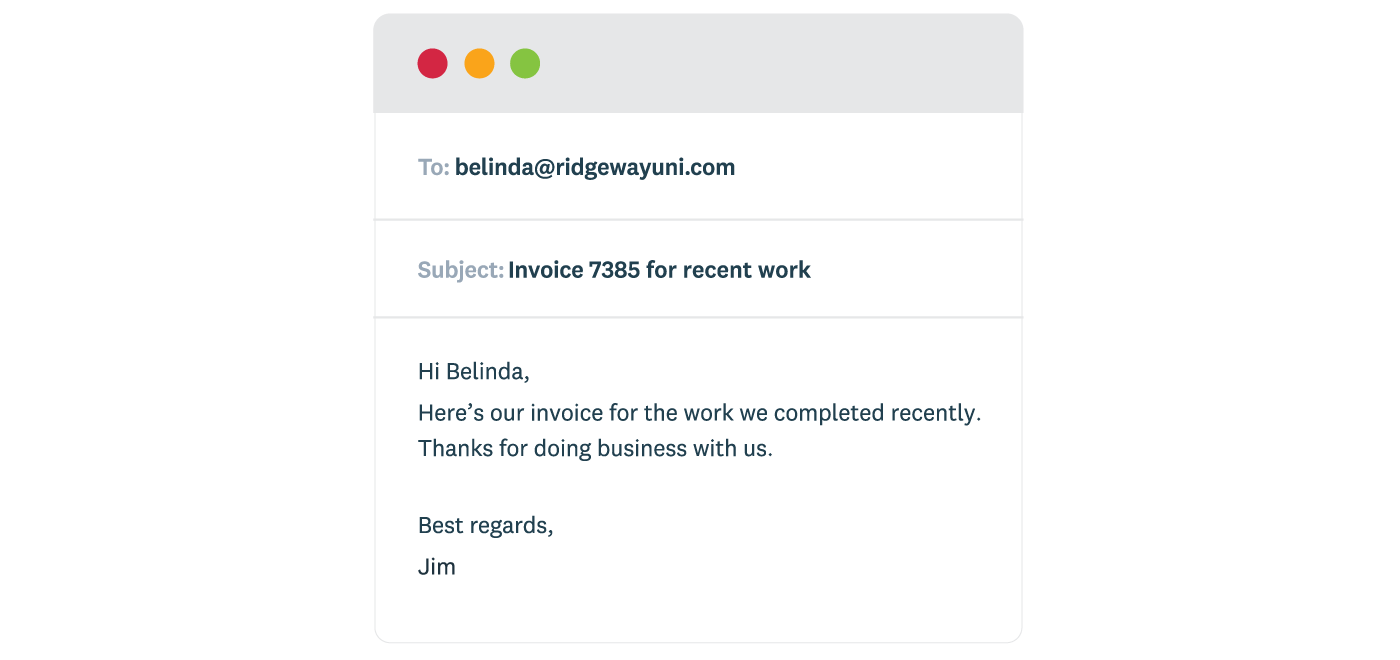

Writing an invoice email

You’d normally send a short email message with your invoice. The most important part of your invoice email is the subject line. The customer may pay faster if you give them a reference like the purchase order number. You can ask your customer’s accounts payable department what they like to see as the email subject.

You don’t need an elaborate message in the body of the email. A greeting and single line message is enough. The invoice itself contains everything else the customer needs to know.

What happens next?

You’ve sent the invoice but the invoicing process isn’t finished. Follow-up action might be needed to get it paid. The next chapter covers tips on the accounts receivable process and collecting payment.

Disclaimer

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

How to invoice

Looking for help on making and sending invoices and getting them paid? Check out these tips on the art of invoicing.

- What is an invoice?

What exactly is an invoice? What does it do and what are the core building blocks that make one? Let’s take a look.

- How to make an invoice

You’ve done the work; now it’s time to get paid. Let’s walk through the process of making an invoice.

- How to send an invoice

How you send invoices can have a big impact on how quickly you’re paid. Let’s look at some of the basics.

- The invoicing process

Sending a bill is just one part of the invoicing process. Find out what else it takes to get paid.

- Tools and guides for your business

Running a business takes a lot of hard work. Xero’s got resources and solutions to help.

Download the guide to invoicing

Learn how to create and send invoices that get opened, understood, and paid. Fill out the form to receive our invoicing guide as a PDF.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Safe and secure

- Cancel any time

- 24/7 online support