Xero Small Business Insights (XSBI)

We use anonymized and aggregated data to track the performance of, and improve understanding about, small businesses.

A quick introduction to Xero Small Business Insights.

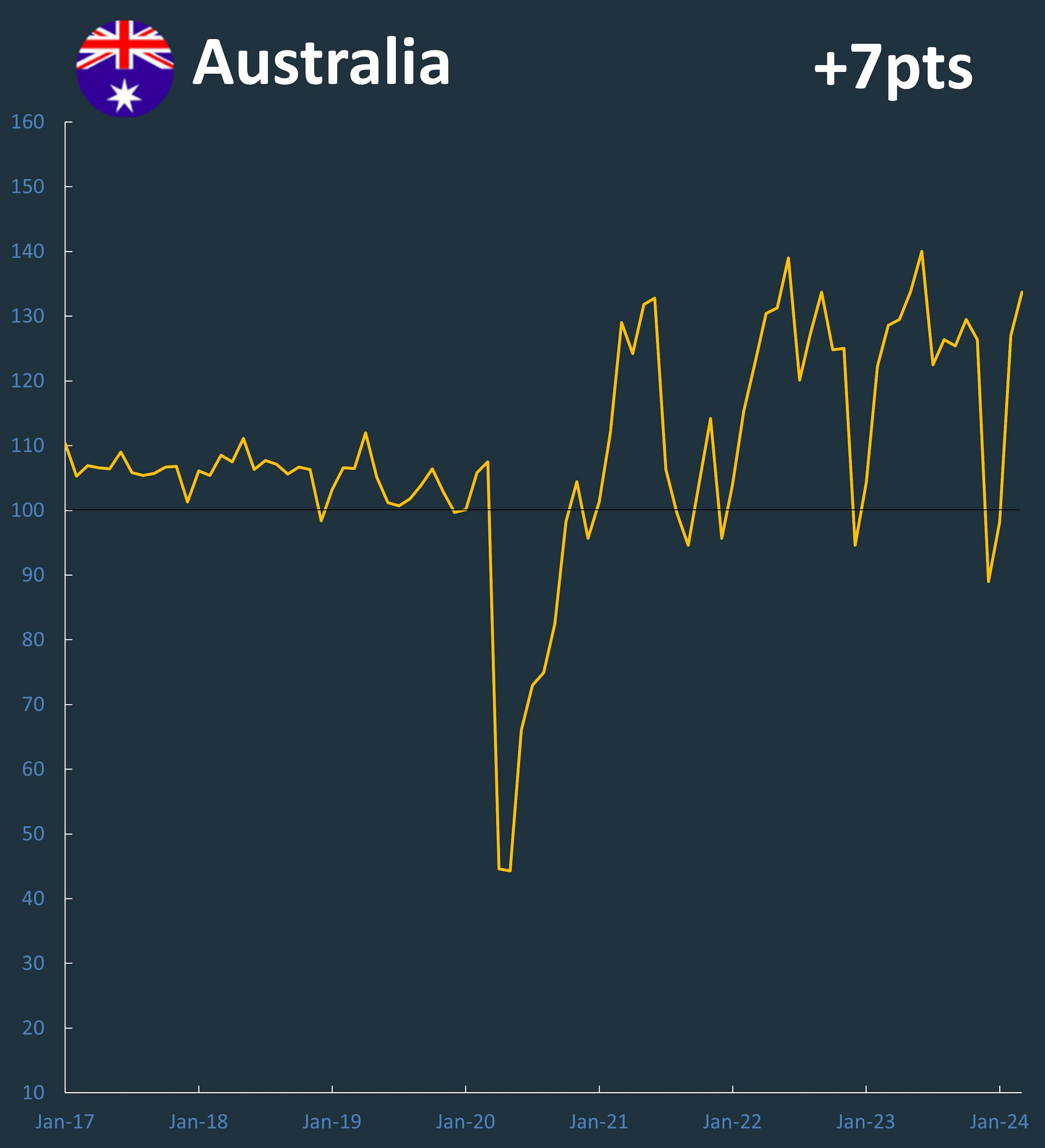

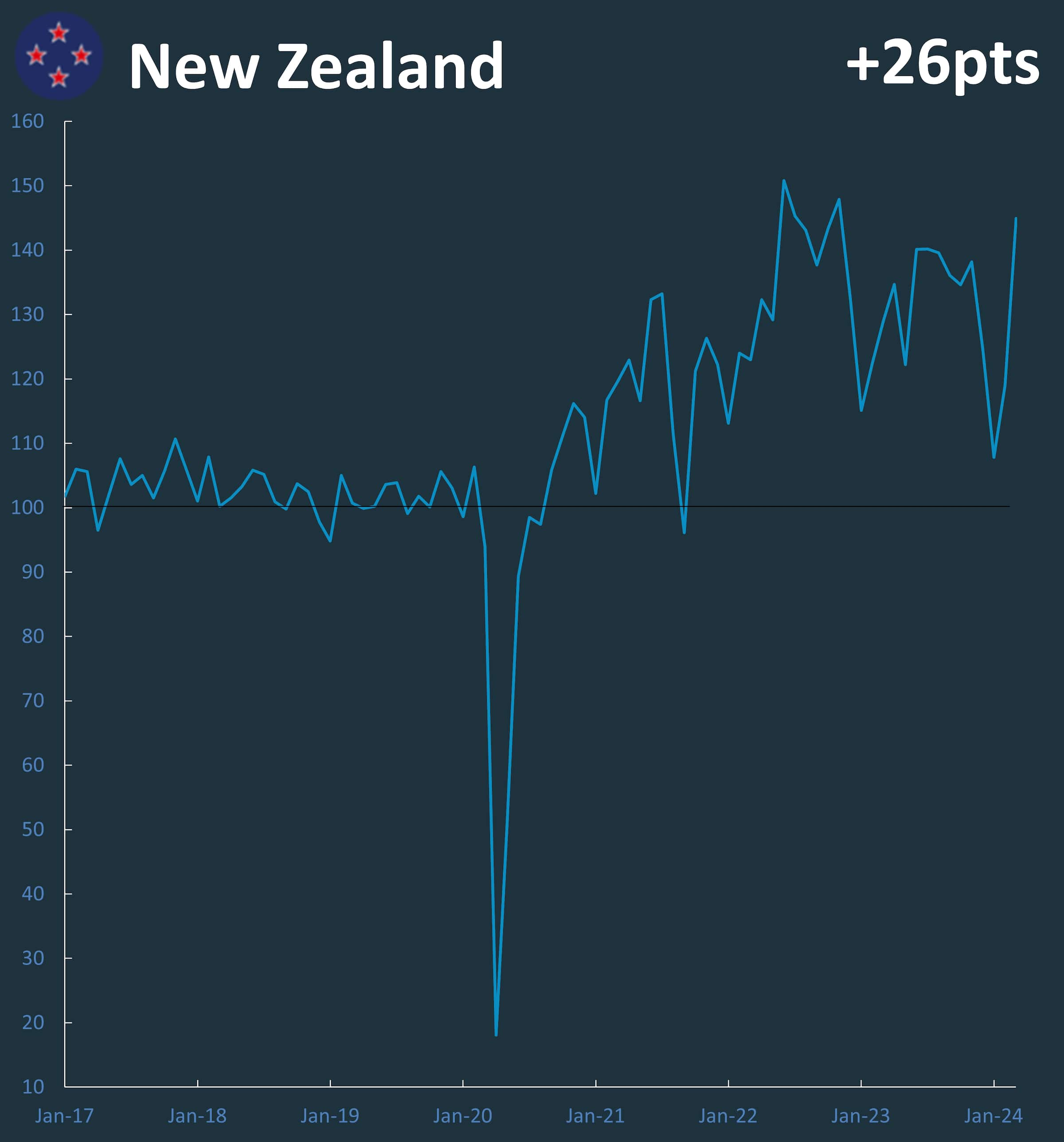

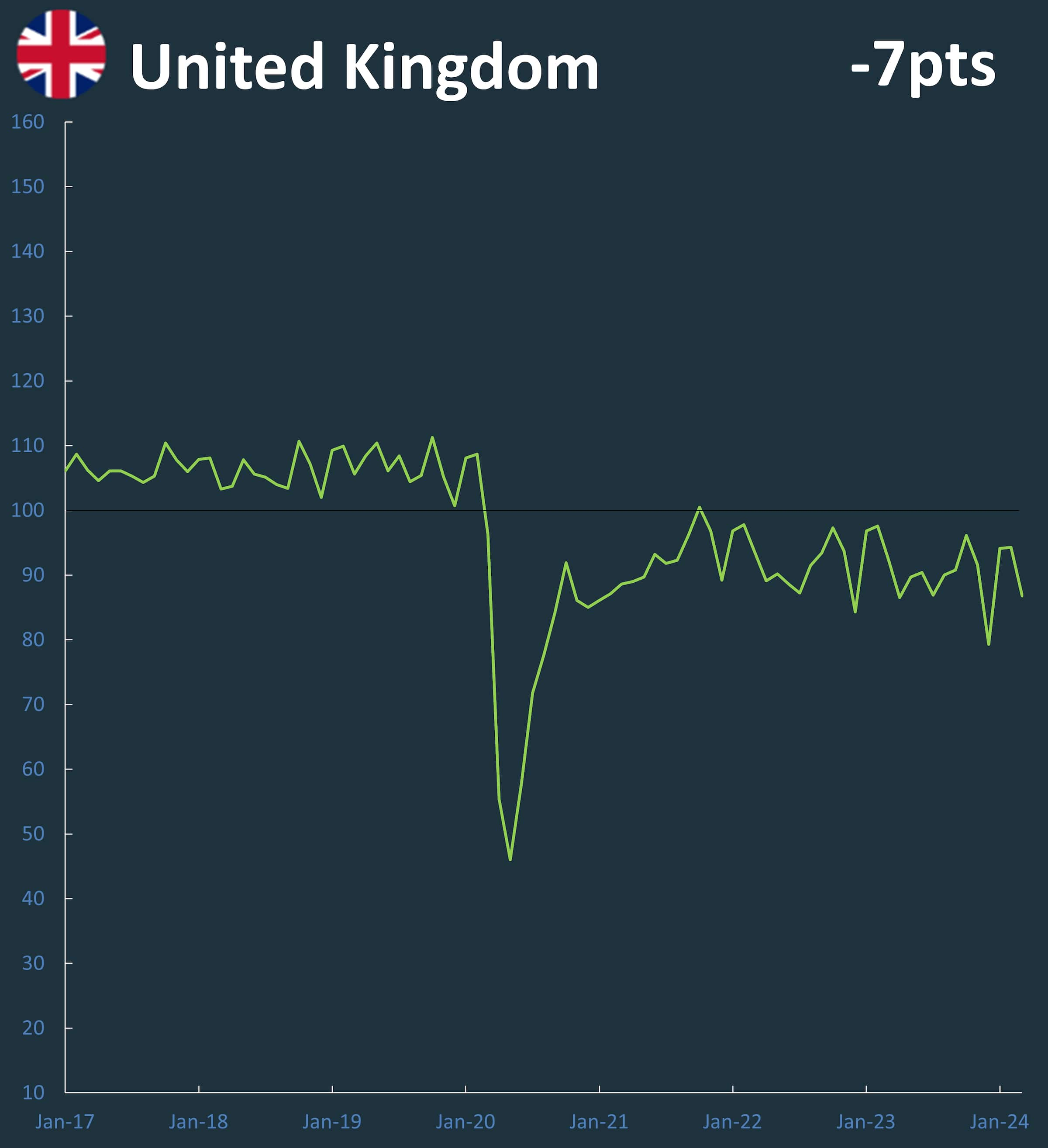

Xero Small Business Index

The Xero Small Business Index is a single measure that shows changes in the performance of small businesses from month to month.

The United Kingdom Index

The United Kingdom's Small Business Index fell 7 points in March to 87 points

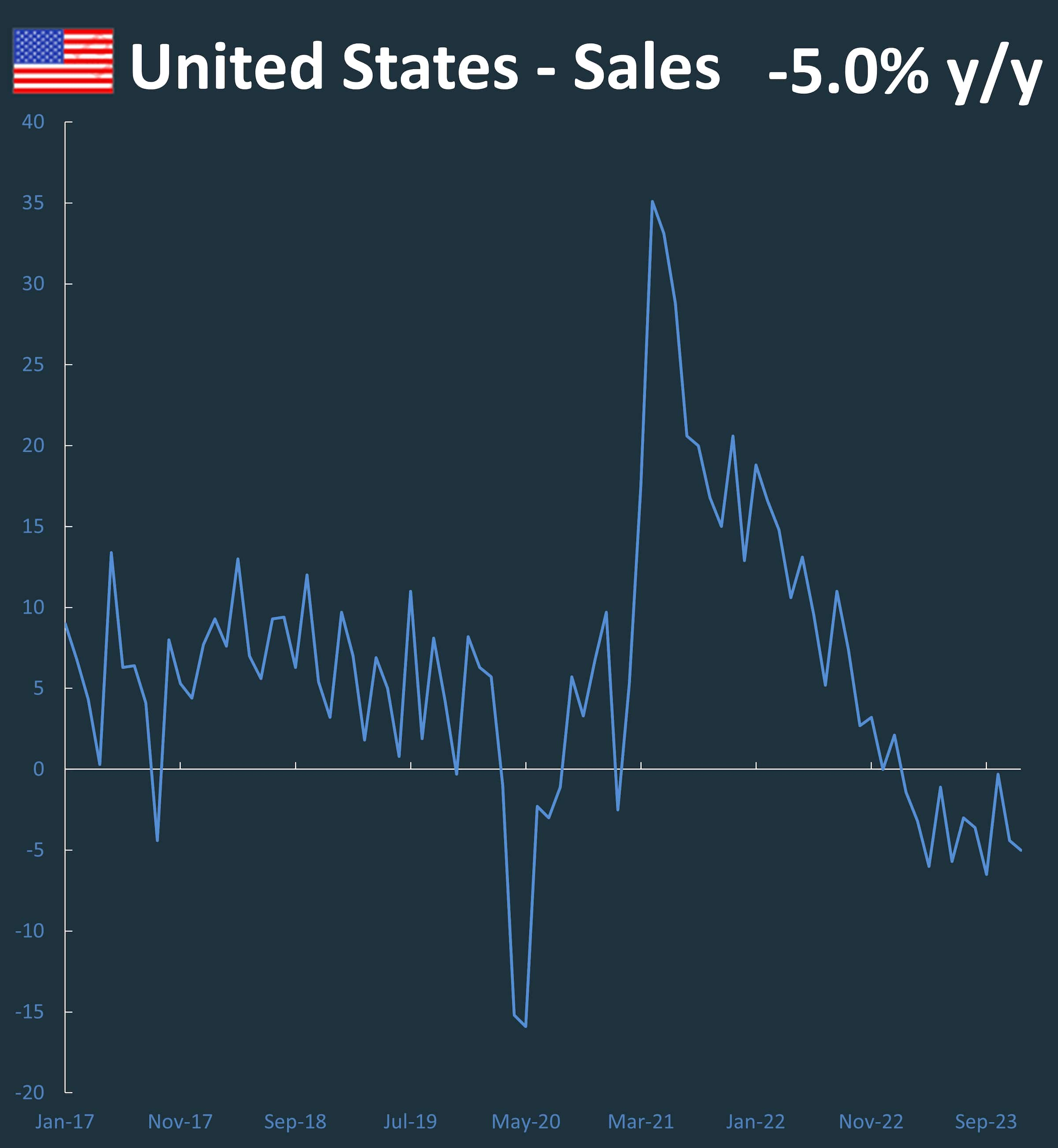

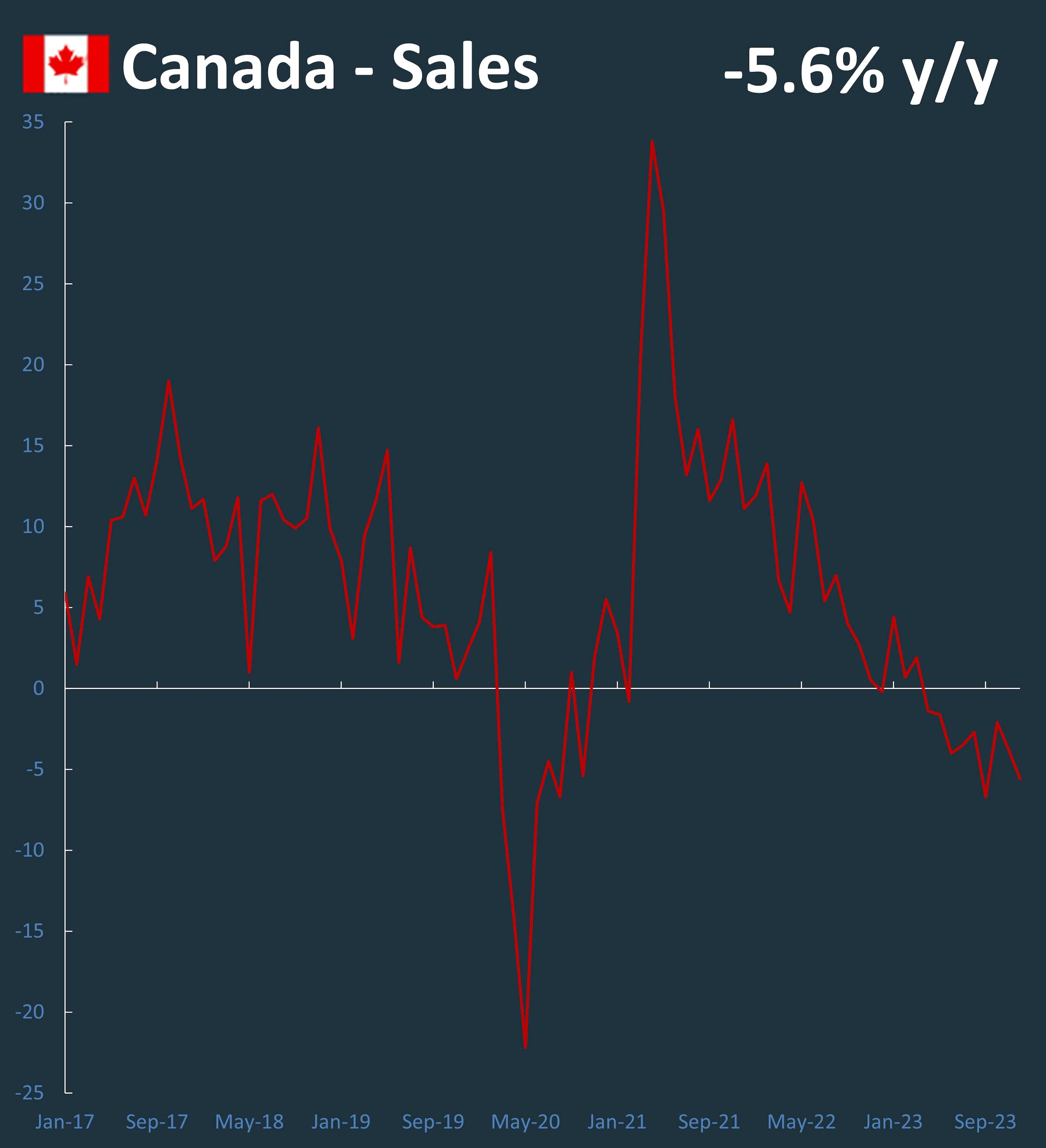

Small business sales

In Canada and the United States the main indicator we track is small business sales, measured in year-over-year (y/y) terms.

Global updates and data

Latest global report

The latest on the state of small businesses around the world.

Latest data

Download all the Xero Small Business Index data in Excel format.

Methodology

An explanation of data sources and how the index is constructed.

Small business research hub

For deeper insights and analysis, explore the latest commentary, research, and data from the global small business sector.

Commentary and research

Find the latest economic commentary and research, viewed through a small business lens.

Special reports

Take a deep dive into specific small business data and topics.

Mindset and wellbeing research

Explore research into the mindset, motivations, and wellbeing of small business owners around the world.

Contact us about Xero Small Business Insights

Arming small business owners with simple but powerful insights. If you have any questions, reach out to us.