Three top tech tips for US landlords in a challenging real estate market

This blog post is written by Logan Ransley, Co-Founder of Landlord Studio – rental accounting and property management software to over 4000+ self-managing landlords (managing 38,000+ properties) to help them stay organized and prepared for the tax season.

Real estate investing is one of the best ways to build long-term wealth. However, the COVID-19 pandemic and subsequent recovery period have added new stresses to the market. Thankfully, despite these complications, there are software solutions that can help investors find new deals and streamline operations.

Here, we take a look at three current real estate trends in the US, including rent arrears, inflation, and the reduced housing stock. We also explore what landlords and real estate investors need to know in order to combat these market stresses and the growing role of technology.

1. Growing rent arrears

Following on from the COVID-19 pandemic, a variety of unfolding economic factors have negatively impacted many people’s finances. Alongside inflation, rents have increased, house prices have spiked, fuel is more expensive, and, despite the cost of living increasing drastically, wages have seen little to no growth in the majority of the United States.

The impact of this increased financial pressure can clearly be seen in the rental industry, with an observable increase in missed and late rent payments.

Rent arrear trends we’ve observed

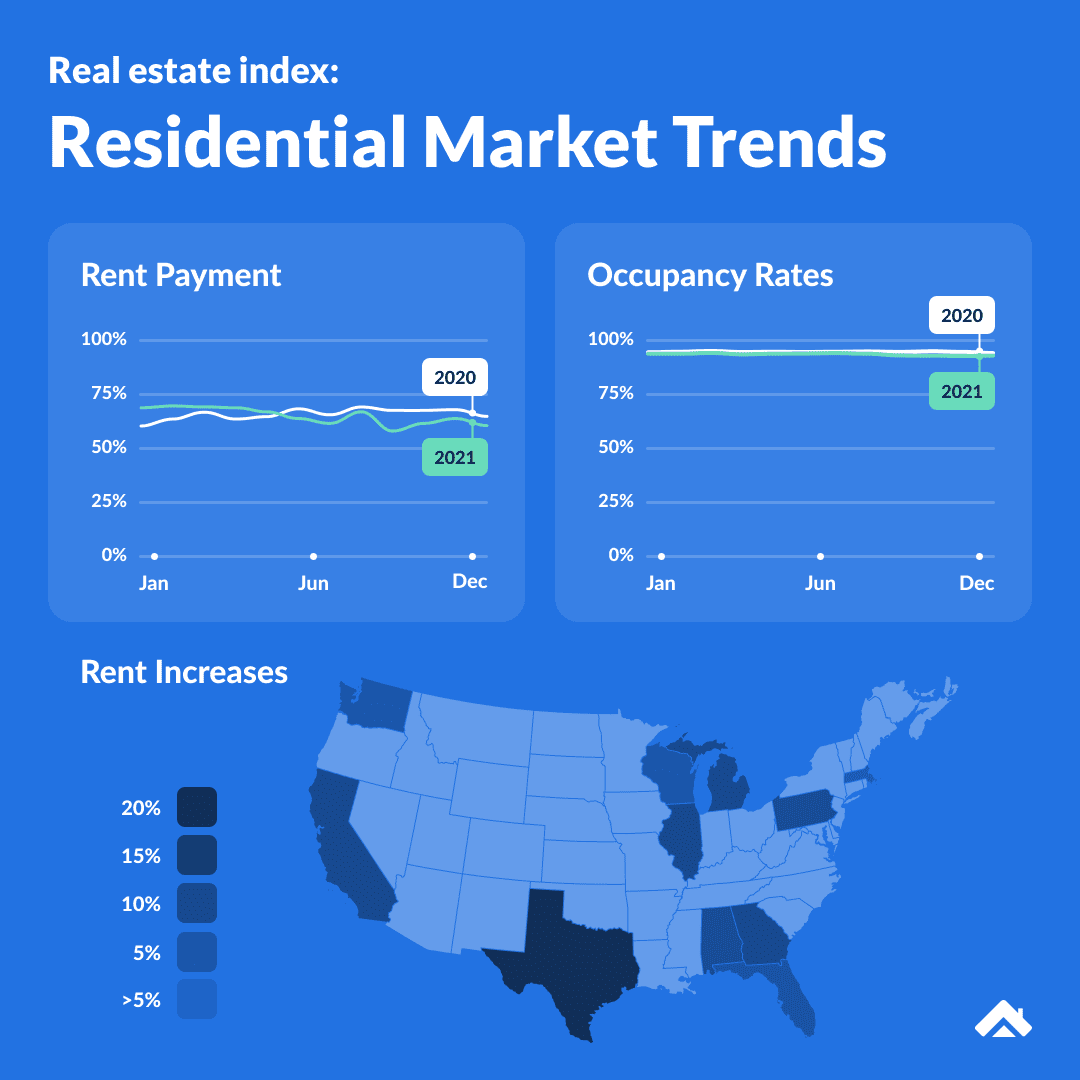

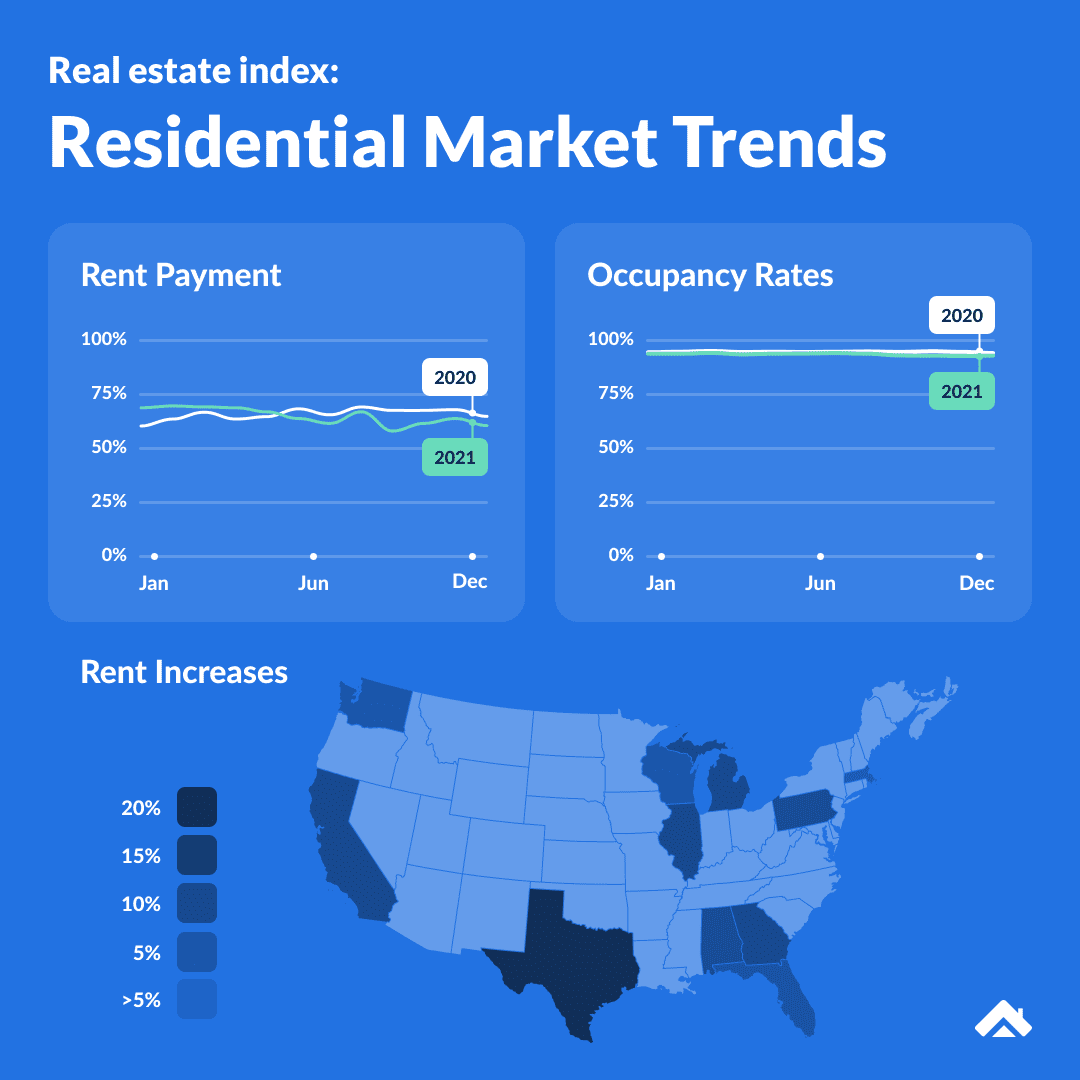

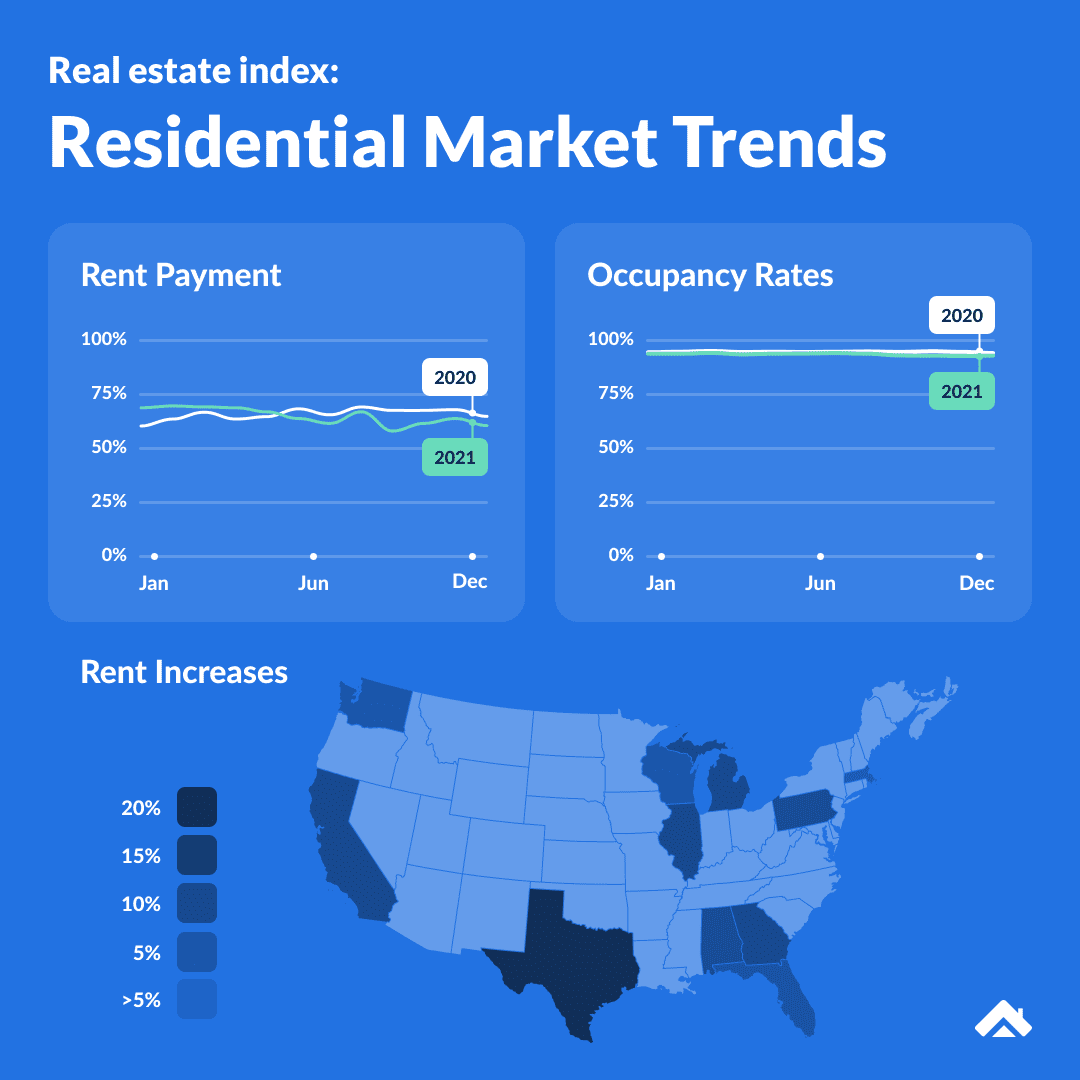

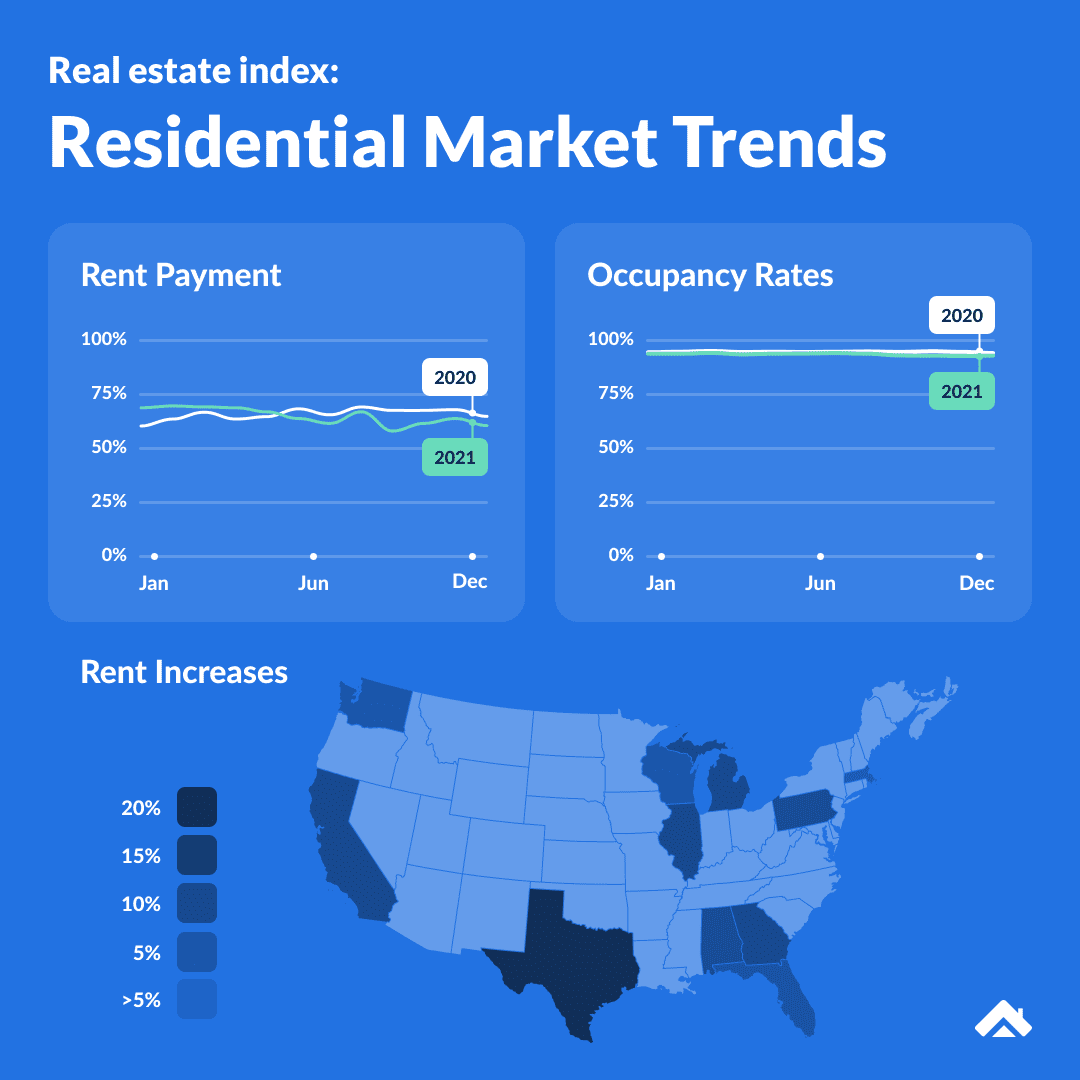

Landlord Studio collates and analyzes data from approximately 30,000 active rental units across the US, and this includes rental payment trends seen over the last two and a half years.

Over 2020 and 2021, we saw relative stability in the rental market, with dips and spikes in rent payments correlating with the first lockdowns and government stimulus packages.

However, as we have moved out of the pandemic and into the recovery period in the first half of 2022, rent arrears* have remained elevated with only around 56% of tenants completing their payments on time compared to an average of 62% in previous years.

While there is little that investors can do to control the external factors, there are mitigating actions that can be taken to limit the potential impact of rent arrears.

The first step, as always, is to secure the best tenants possible, this means having a streamlined tenant application and screening process. Secondly, to employ modern rent collection tools to make it as easy as possible for your tenants to make payments. This will also allow you to obtain and give your tenants oversight of upcoming or owed rent.

Finally, you need financial tracking tools to efficiently track and chase rent arrears. The tools you employ should allow you to quickly run key reports such as a profit and loss or rent ledger report to easily identify discrepancies between expected and collected rent.

*Rent is deemed to be ‘late’ if it is paid more than five days after the rent due date, as this is the standard grace period used by most landlords in the US.

2. Inflation and interest rates

These rising costs aren’t just impacting tenants. It means the profit margins for your real estate business are also going to be squeezed. The US government reported that consumer prices climbed 8.6% over the year through May, the fastest rate of increase in four decades. On top of this, typical rates on 30-year fixed-rate mortgages have shot up from historic lows of around 3% to around 6%.

There are a few things that investors will see in response to these rising costs. The first is that property owners are experiencing high levels of appreciation, as property values keep in line with inflation as well as the rising costs of real estate development.

Additionally, rents continue to rise. In fact, according to CoreLogic data, average nationwide rents increased 10.2% year over year by September 2021. Alongside this spike in rents, however, is an expected corresponding spike in vacancy rates.

With the increasing cost of debt and high demand for real estate, buying new property may be something to hold off on. Instead, you should focus on streamlining your property management and accounting to help you with tenant retention, and reducing overheads to ensure your rental business is stable and well-positioned in an uncertain market.

3. Decline in housing stock

According to data from the U.S. Census Bureau, as of May 2022, the inventory for single and multi-family homes for purchase is at its lowest in over forty years; around 700,000 compared to a historical average of 1.5 million.

This reduction in housing stock, increased competition from large firms, and delays in property development all mean more competition for real estate assets, which in turn is pricing people out of the market. This is resulting in more people renting and forming a barrier for smaller portfolio landlords.

How can software help investors address this challenge? Firstly, keeping accurate and up-to-date records with quality income and expense tracking software enables you to identify weaknesses in your real estate business, decrease overheads, increase income, and allows you to approach lenders from a position of strength.

Second, using data-driven insights from market comparison software such as Mashvisor, Rentometer, and Zillow Zestimates, paired with publicly available data for local investments in business and infrastructure, should enable you to identify quality opportunities, even now.

Finally, software can help you find great tenants, stay organized, and more efficiently manage your properties.

Final Words

Technology offers a variety of solutions to address the new challenges that are emerging in the real estate industry. Market comparison software can offer data insights to help you secure that next great deal. Accounting software like Xero empowers you with greater financial insights and helps streamline your taxes. Finally, property management software like Landlord Studio can help you optimize the day-to-day management of your portfolio and stay on top of your bookkeeping.

Find out more about the Landlord Studio app, available from the Xero App Store.