Xero Small Business Insights (XSBI) data for April 2022 shows signs of emerging risks to small businesses in the UK, Australia and New Zealand. The rising cost of living pressures, inflation, ongoing supply chain issues and tight labour markets are some of the key factors contributing to small business performance.

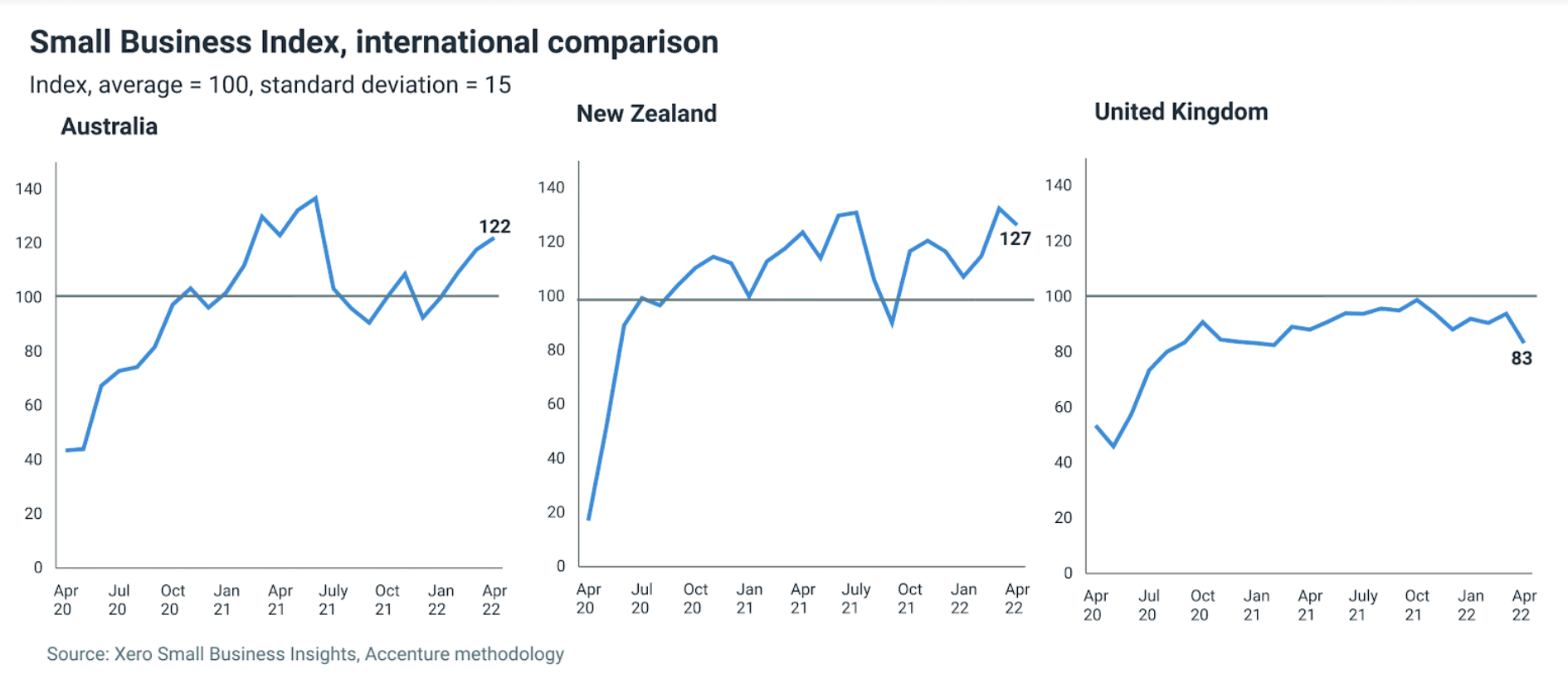

The Xero Small Business Index is a unique indicator that uses timely data to show how small businesses are performing overall each month. The Index is based on four key measures of jobs, sales, time to be paid and wages, and shows performance changes in the short and long term.

Cost of living pressures hit small business sales, wages continue to rise

In recent months we’ve seen small businesses in the UK, Australia and New Zealand demonstrate strong sales growth, however in March and April sales growth slowed across all three countries. Sales rose 6.3% year-on-year (y/y) in the UK after 13 months of double-digit growth, 5.8% y/y in Australia and only 2.9% y/y in New Zealand. This slowdown in sales is likely an early sign of the impact of the rising cost of living affecting consumers’ capacity to spend.

Another trend we’re seeing in the small business sector is rising wages. Wages rose 4.5% y/y in the UK in April, 4.1% y/y in Australia and 4.8% y/y in New Zealand. The impacts of inflation mean real wages are falling, which is reducing the purchasing power of consumers. Essentially, inflation is hitting small businesses twice. Not only are they dealing with rising costs, but their potential customers are tightening their purse strings. This blog post from Xero Economist, Louise Southall, explains the impact of inflation on small businesses in more detail.

Late payments adding to challenging conditions in the UK

In the UK, the Xero Small Business Index in April was 83, its lowest point since February 2021 and the most drastic monthly fall since April 2020. British small businesses continue to face challenges, now with the slowdown in consumer spending and having to wait longer to get paid. The time it took for small businesses to be paid on average increased to 29.9 days in April. Similarly, they experienced the longest late payment time since September 2020, at an average of 7.7 days late.

What small businesses can do to manage the current challenges

With so many factors putting pressure on small businesses right now – from increased costs, supply chain issues, to having to increase wages, and experiencing slower sales, here are some tips for small businesses to help them cope:

- Know what your costs are doing: Getting data into Xero is the first step to having visibility over the costs flowing in and out of your business. There are many ways to do this, from recording your transactions with bank reconciliation, to adding bills and receipts using Hubdoc. You can then make the most of tools like reporting and Xero Analytics, to see where you stand and better manage your cash flow.

- Consider if a price increase is right for your business: In this environment of rising costs, one of the few ways you can maintain your profit margins is to increase prices. With inflation rising so quickly, potential customers are facing their own rising cost of living pressures, so be sure to get advice from your accountant or bookkeeper on whether you need to increase your own prices and by how much.

- Focus on non-cost related aspects of your business: Think about how you can provide excellent service that will keep customers coming back. Personalising your service is one way to do this, for example through more targeted communications using the information you have about your customers. Another way is to start a loyalty program that offers recurring customers rewards like discounts or bonus services or products.

- Get creative with employee benefits to retain staff: Increasing wages is not the only thing you can do to keep staff. Think about what else you can offer employees. Consider how you can make your workplace one where employees feel comfortable, empowered and motivated to do great work. Create a culture of recognition and celebration, and create opportunities for your team to connect and get to know each other better. Developing an open, collaborative and friendly culture can help reduce stress, improve happiness and increase productivity.

With so many factors influencing operating conditions for small businesses, it is vital that you stay across your finances and work closely with your trusted advisors to make the right decisions that will allow the business to stay profitable.

Read more about the XSBI metrics for April in these updates:

Or visit the XSBI homepage.