Magic in action: Why customised reports are the lifeblood of Aegis

As we continue rolling out the additional value to Xero’s new reports, we’re thrilled to see small businesses and practices everywhere embrace them with fervour. From easier access to your favourite go-to reports, more personalisation in how they look to customers, and enhanced customisation that offers better clarity and control over the numbers, our goal is to help you streamline your financial analysis and get the answers that matter, quickly.

Founder and managing director of Aegis Business Services, chartered accountant Tori van der Donk depends on Xero’s reporting suite not only to help her clients understand where they stand now, but also to make informed plans for the future. Recently, she sat down with me to tell us all about how crucial reports are in her business, and why being able to customise them is the lifeblood of her work.

How long have you been using reports in Xero?

Almost eight years. In fact, Xero was one of the reasons I had the confidence to go out on my own in the beginning. I’m a bonafide early adopter because I’m drawn to products designed with innovation and logic at their core, plus I loved how Xero pulled down the traditional barriers to entry for budding practice owners like me. When reporting, I need flexibility of both place and time, so having the option to work in the cloud – in contrast to desktop-based servers – is crucial.

How do you use reports in your practice?

Gee, how long is a piece of string? We use reports for everything! Our most-loved is Account Transactions, and we often customise it with added columns depending on our clients’ needs. Otherwise, we very commonly pull together payroll employee and payroll activity reports, balance sheets, P&L and activity statement reports.

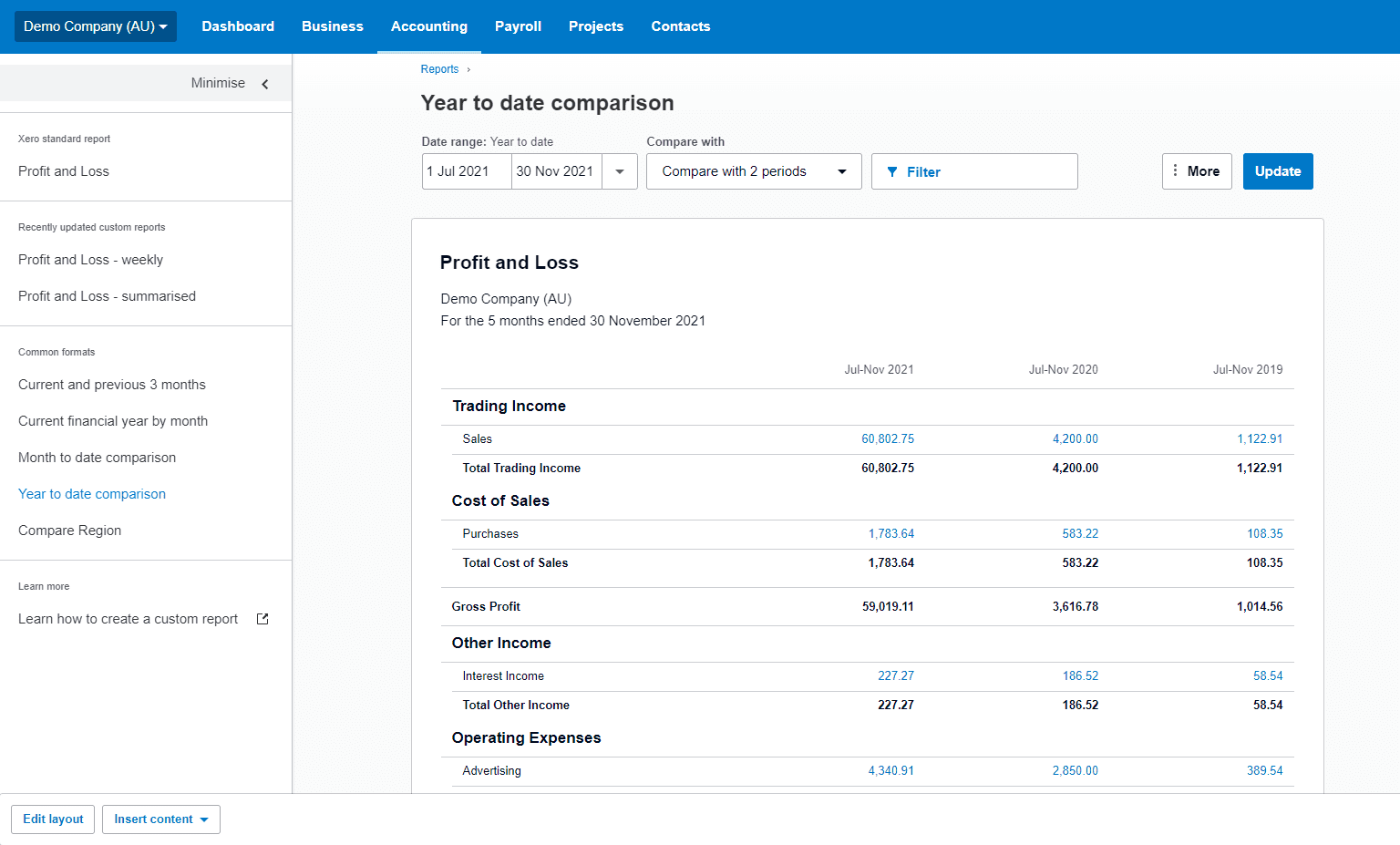

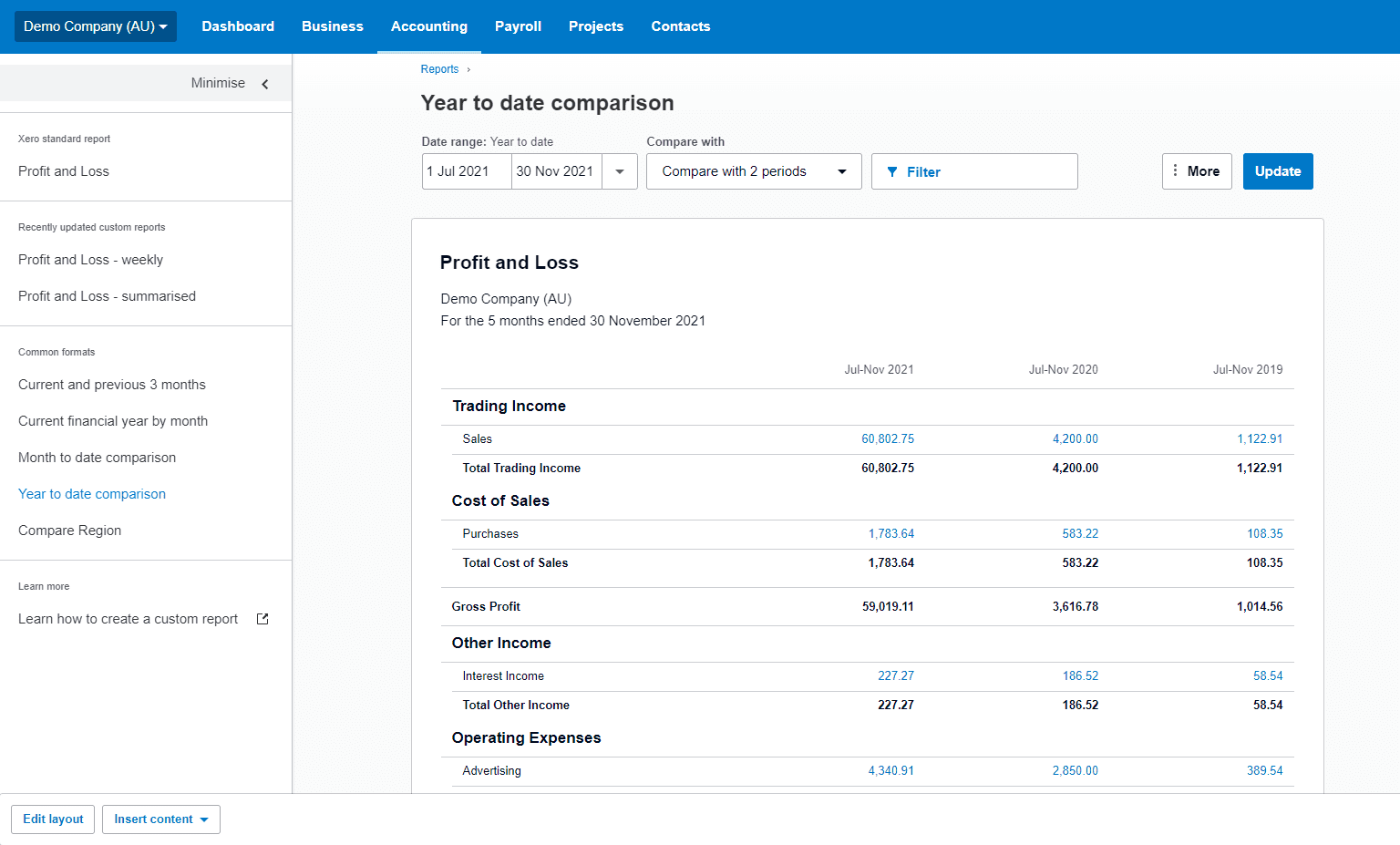

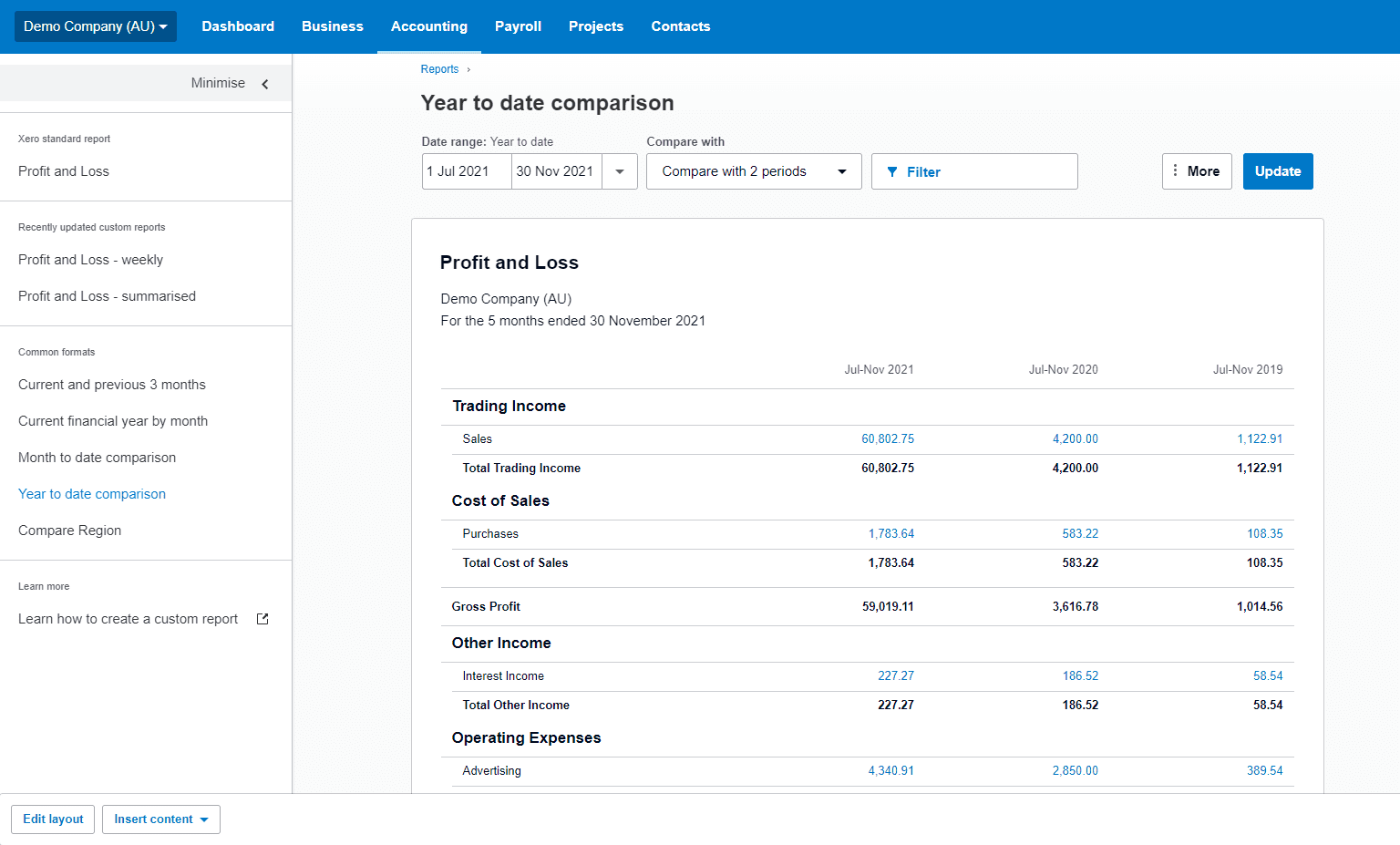

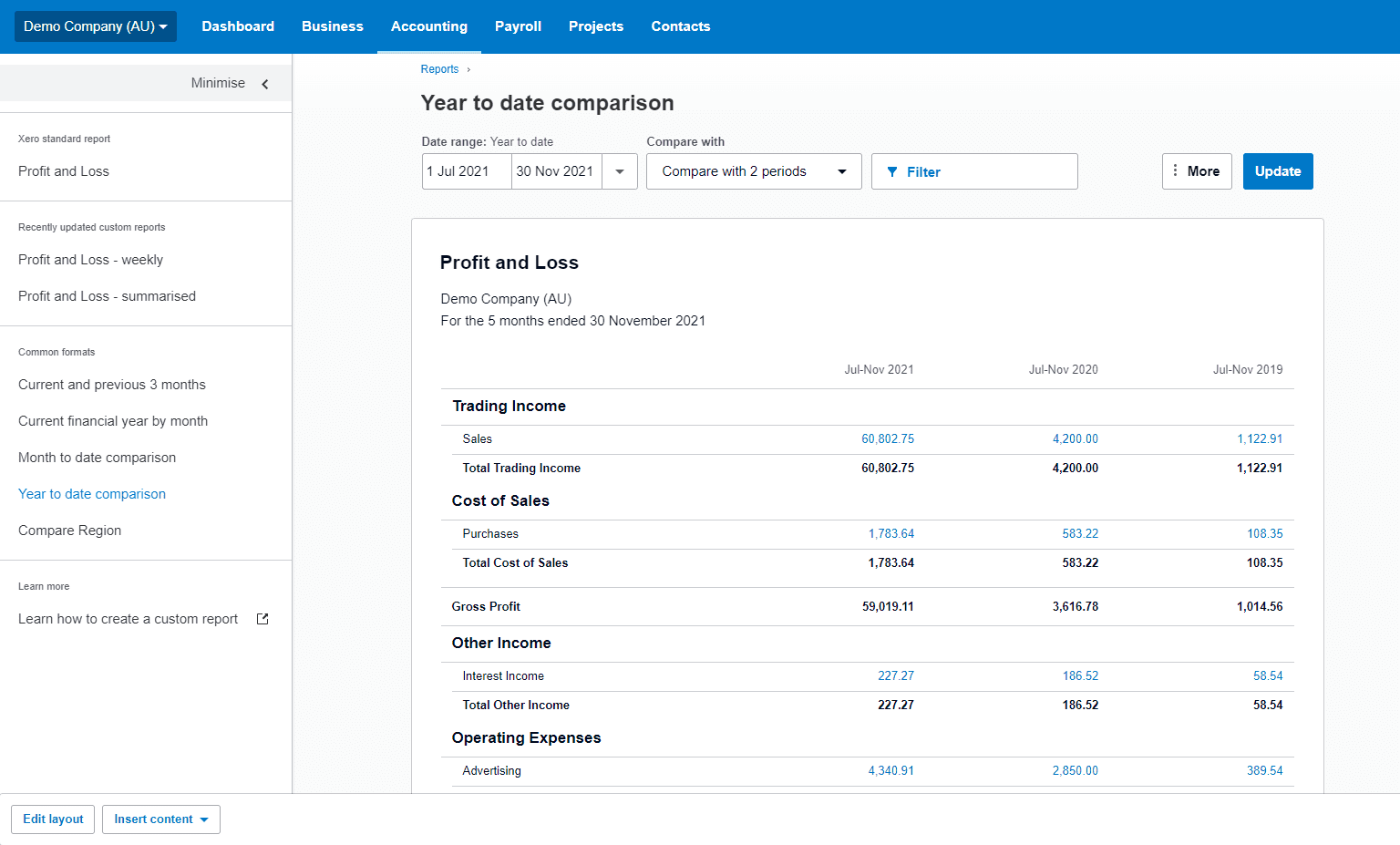

Given the nature of our business, we also create custom report packs which include a monthly management report. This is sometimes customised further at a client level with grouping or formulas (for example, GP %), and BAS packs, complete with not only an Account Transactions report, but a Balance Sheet and Profit and Loss report that shows the comparison to previous quarters, and the QTD and YTD figures.

We also customise payroll reconciliation packs with a P&L customised from report codes, only showing detail and sub-totalled amounts for wages and salaries while summarising all other accounts in collapsed groups. This allows us to focus on what is important for internal review purposes, and then create year-end annual accounts for each entity type, which come pre-populated with our firm’s details.

One thing we often see is that clients love to name their own accounts, and sometimes this means they can have 300 accounts when just one would do. So, we customise reports to group these, or rename them so they’re more presentable from an accounting point of view. In short, reports are central to how we operate, both for ourselves and our clients.

What impact does being able to customise reports have for you?

As many practice owners will understand, our client base is very diverse. So, as much as we’d like to standardise the way we run and organise our reporting capability, it really doesn’t work that way in reality. Of course, we could always force our clients to ‘our way’ of doing things, but we know that’s not actually going to be any good for their business, so customising our reports in a way that offers them only what they need to know (in essence helping them to feel confident in their decisions) means we can offer a more bespoke service.

Why do you enjoy using new reports?

I love the new reports because they are so much more customisable than Xero’s older reports. In particular, I love the additional filters on the Account Transactions report, and I’m thrilled about the ability to select accounts with zero balances. Every new organisation I go into, my personal habit is favouriting it so I have easy access to it as a general ledger. I also use it to find issues in reconciliations and spot-check the details in particular accounts. It’s so easy now to drill into the original transaction in a new tab, and once fixed, the original report updates with a single refresh.

In addition to this, I’m enjoying the new sidebar on the P&L and balance sheet reports, and of course watermarks. We often get asked to provide draft financials for the bank’s use, where the year-end work isn’t ready yet. In the past, we’ve had to purchase additional software to export the PDF and add a ‘draft’ watermark before sending it on. Now, we can do it within Xero, and just add it to our document packs.

I usually spend hours teaching each and every staff member how to manually add in ‘Total’ and ‘YTD’ columns (and then reteaching them again when they inevitably forget), so being able to simply tick a box for this column to display has been a lifesaver. My own, and I’m sure many other bookkeepers, aren’t involved in this type of reporting regularly, so they shouldn’t really need to remember how to customise to this extent.

How do new reports make your practice more efficient?

It’s so much easier now to gain efficiencies in our practice by creating report templates that we’ve customised for our needs, like BAS packs, which we use to facilitate an easy review of BAS prep work by our supervisors. Without them, we’d need to charge much higher fees to our clients because of all of the time we’d spend on creating Excel templates, or paying for other apps that allow us to do it to our requirements.

In all honesty, I don’t know how a practice can provide advice to a client without detailed reports, given each client has such different needs. Without seeing the detail customisation offers, I think there’s potential for things to be missed and incorrect assumptions acted upon, and of course, if incorrect information is provided to the tax authority, the financial implication of this can be significant. Being able to customise (and save configurations of) reports means that we can set up reporting once, tweak them if needed, and then get the correct information each time that report is rerun.

Overall, new reporting has provided me with quicker access to answers, more powerful customisation and better streamlined financial analysis. If you’ve not already tried the new reports, I’d definitely recommend giving them a go.