At Xero, we believe every small business should have access to trusted, insightful data that helps them understand where they are now, and where they might be in the future. That’s why I’m thrilled to announce that we’ve developed a powerful new tool called Xero Analytics Plus, which is available from today.

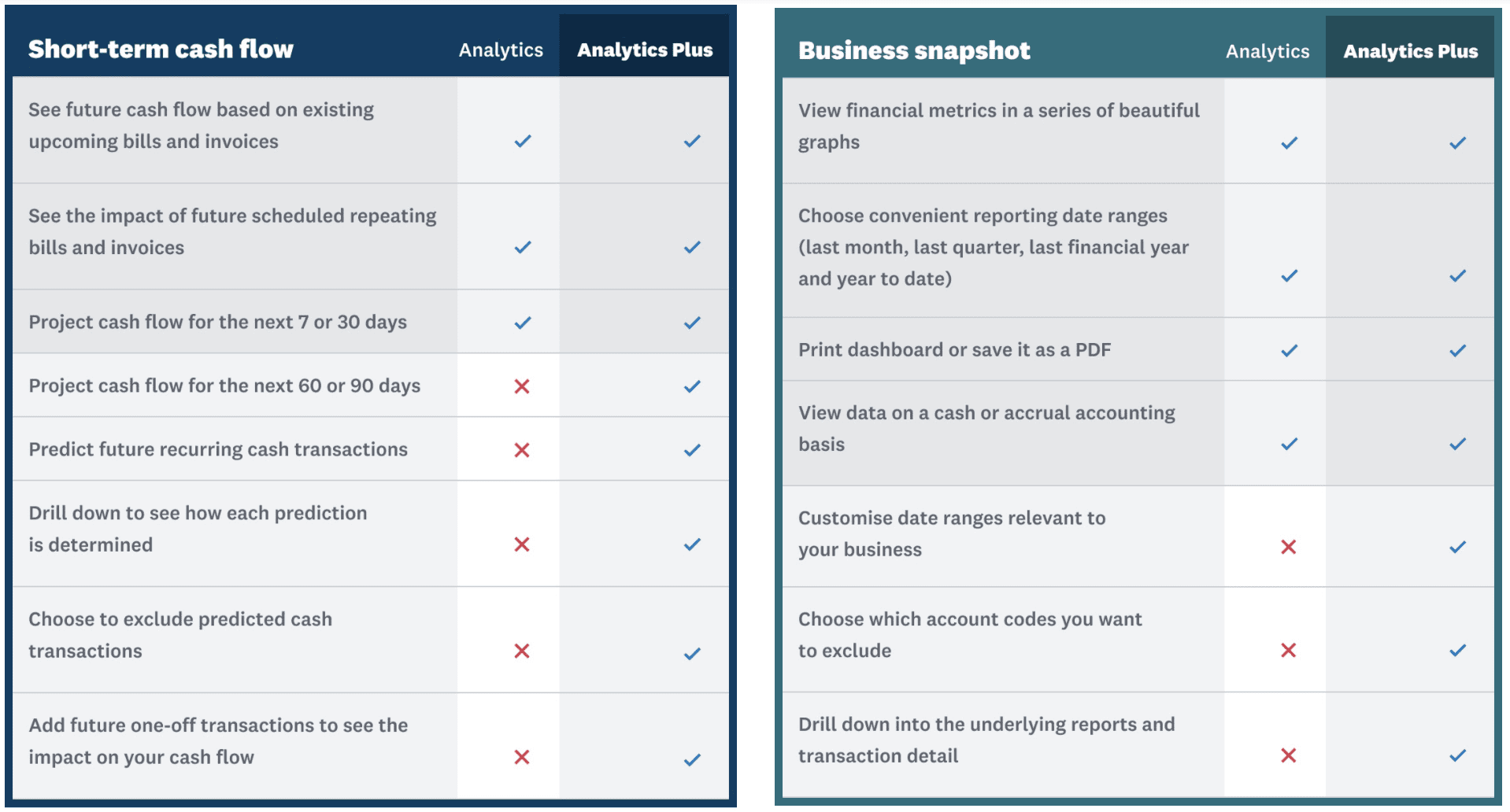

Analytics Plus is the next evolution of our short-term cash flow and business snapshot features, with greater customisation and more accurate projections. We’ve also bundled short-term cash flow and business snapshot into a free tool called Xero Analytics. It comes with some exciting new features, to help you better manage your cash flow and measure your financial performance.

Powerful predictions at your fingertips

If you’re like many businesses, you probably use a number of different tools to predict what your cash flow might look like in the future. With Analytics Plus, you can do it all within Xero, using data from your Xero account to analyse trends and get a deeper understanding of how your business is performing. You can:

- view a projection of your bank balance 7, 30, 60 and 90 days in the future, to give you better visibility of your potential cash flow in the longer term and help you plan ahead

- see a prediction of future recurring transactions in short-term cash flow (such as Xero Payroll expenses), in addition to repeated invoices and bills that are already scheduled

- manually add or remove transactions, so you can see how certain changes might affect your cash position and do some scenario planning

- quickly analyse trends in your business performance, by customising the date ranges and account codes displayed in business snapshot

- drill down to a transaction level at any point, to see how we’ve arrived at a particular prediction

The beauty of Analytics Plus lies in its simplicity – the dashboards are clean, simple and easy to use. Even after launch, our predictive algorithms will keep improving, providing better forecasts and actionable insights to help your business thrive. It’s also useful for advisors, giving them the opportunity to have deeper conversations with clients and help them plan ahead.

What customers say about Analytics Plus

“I feel that as a business owner, Analytics Plus reduces the anxiety of cash flow. It is quite stressful when you employ people and have bills to pay. Just knowing that you’re going to have enough money to cover everything – I feel like you can’t really put a price on having your stress levels reduced.” — Small business owner, NZ

“I really like the business snapshot tool in Analytics Plus. It is very helpful for me to take a look at the year-to-date view and compare my performance (like revenue earned and revenue billed) to last year and my internal goals. I am constantly trying to grow my revenue and this is making it much easier.” — Small business owner, US

Adding more value to your Xero plan

When COVID-19 first hit, we released our short-term cash flow and business snapshot tools to all customers free of charge. These tools help you visually project your potential bank balance 7 or 30 days into the future and get insights on your business performance, so you can spot opportunities and mitigate risks ahead of time.

We’ve now bundled these tools and renamed them Xero Analytics. If you’re on a Xero business plan, they’ll still be available free of charge, located under the ‘Business’ tab on your dashboard. The tools in Analytics also have some exciting new features that add even more value to your Xero plan. You can now:

- click on any point in the short-term cash flow graph to view the cash going in or out that day

- enjoy the flexibility of grouping your cash flow projections by day, week, or invoices/bills

- choose whether you want to see your invoices and bills in a summary or table view

- see scheduled repeating bills and invoices in your short-term cash flow dashboard

- view business snapshot data either on a cash basis (when you pay or receive money) or an accrual basis (when you get a bill or raise an invoice)

You may have already noticed the beautiful new look for short-term cash flow that has been released with these changes. If you haven’t already, I encourage you to take a look at Analytics on a regular basis and talk to your advisor about what actions they would recommend, so you can focus on what’s most important in your business.

Try Analytics Plus for free until 31 January 2022

Xero Analytics Plus is now available as a paid add-on in all regions except the US and Canada, where it is included in Established and Premium plans. If you’re on a Starter, Standard or Premium plan, you can try Analytics Plus for free until 31 January 2022. Once the free period has ended, the standard pricing will apply.

If you’re a Xero partner, don’t forget to register for our upcoming webinars, where the team will show you how to make the most of Analytics Plus in your practice.