With Making Tax Digital (MTD) ITSA (Income Tax Self Assessment) regulations starting from April 2024, all landlords and business owners with an income above £10,000 will need to submit a quarterly summary of their business’ income and expenses to HMRC using MTD-compliant software. As a large proportion of landlords will be impacted, we predict that many will look for an advisor in the coming years.

To help you manage your clients easily and efficiently in Xero, join us as we share our new report templates and Chart of Accounts designed specifically for landlord clients. You can also find out how Xero Tax will be imperative for changes in MTD.

An upsizing opportunity for landlords

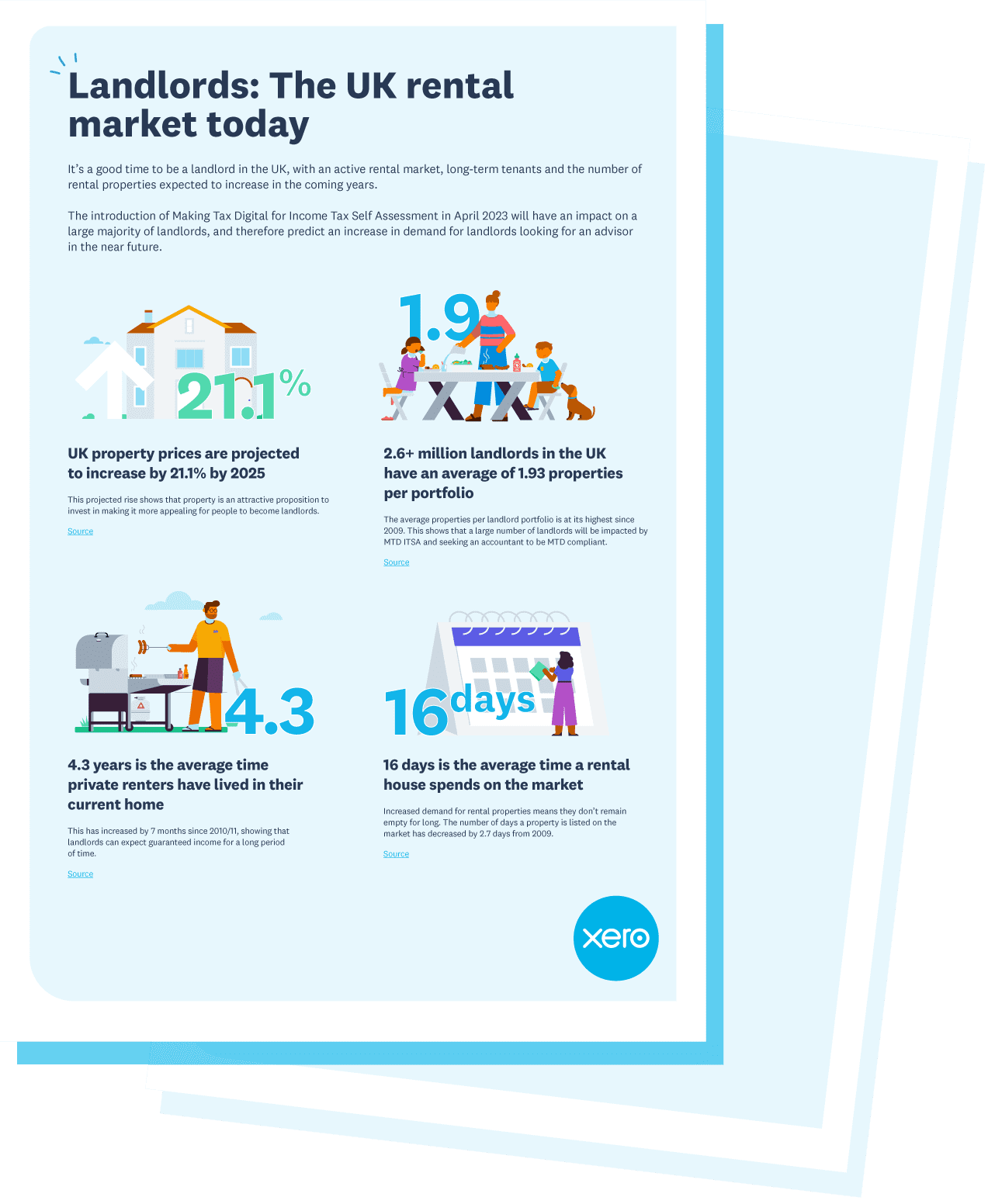

With the government temporarily cutting stamp duty, the tax break initiative has presented landlords with a significant opportunity to expand their portfolios. With an active rental market, long-term tenants and the number of rental properties expected to increase in the coming years – it’s a good time to be a landlord in the UK.

Now could be the perfect time to put your landlord clients on Xero and get them prepared for MTD.

A growing rental market

The percentage share of privately rented households in England is currently at 18.7% of all households. This has doubled in the last 20 years from a little over 2 million in 2000 to 4.44 million in 2020. In addition, social renters make up a figure of around 4 million therefore the total percentage of rental properties in England is approximately 35.4%.

All indications point to the percentage of rental properties increasing over the next decade as the price to rent ratio has increased to 114. The price rent ratio is an indicator of the affordability of owning a property to renting one. When the number is above 100 it is more affordable to rent than to buy. This number has been steadily increasing since 2015, which was the last time the number was below 100. This will result in either an increase in the number of landlords or existing landlords growing their property portfolios, as the affordability for people to own their first home is becoming more out of reach.

The proportion of landlords with five or more properties has increased from 5% to 17% since 2010, and there has been a decrease of landlords that own only one property. With less ‘accidental’ landlords and more professional landlords growing their portfolios, they will require improved reporting to better understand the performance of their portfolios; looking at profit and losses per property and reviewing rent yield to understand how their investment in that property is performing.

MTD ITSA will affect landlords with income in excess of £10,000, which is the equivalent of a landlord who earns £833 per calendar month. With the average rent in the UK as of March 2021 at £996, this means a large proportion of single home landlords and multiple property landlords will be impacted. This larger number of landlords will need to migrate onto an appropriate solution by April 2023 increasing the need to work with an advisor or fundamentally changing the way they currently interact with their advisor.

How Xero can help with your landlord clients

Managing different landlord clients can be time consuming due to manual processes, so we’ve developed new standardised workflows and reports within Xero to save you valuable time and make managing any type of landlord in your base hassle free. All at no extra cost to your usual Xero subscriptions.

Xero for landlords can help with:

- Standardised workflows for your landlord clients

- Auto coding and fast reconciliation

- Dedicated report templates and bespoke landlord Chart of Accounts

- Xero Ask for information requests

- MTD compliance

- Payment integrations for your clients to help automate rent collections.

You can also manage accounts and tax preparation, filing and compliance tasks for your clients with Xero Tax. Accounts production and self assessment filing for landlords will be available later in 2021.

Join us to find out more

We’re hosting a free 45 minute webinar on 1 June at 10am to show you how the new workflows and reports can bring efficiencies and add value to your practice.

Visit our Xero landlord resource page to hear from other partners using Xero for their clients and watch short educational training videos. You can also download a dedicated Xero for landlords support pack that includes a specialised report and a Chart of Accounts, client flyer and a Xero for landlords playbook.