Change to reduced rate for VAT from 1 October 2021

This article was updated on Monday, 4th October 2021.

HMRC has announced a change to its current temporary reduced rate of VAT for hospitality, holiday accommodation and attractions industries.

From 1 October 2021, a new reduced rate of 12.5% will apply. This will remain in effect until 31 March 2022. The new rate should be used instead of the 5% reduced rate that is in effect until 30 September 2021.

The new flat rates for types of businesses can be found on the HMRC website.

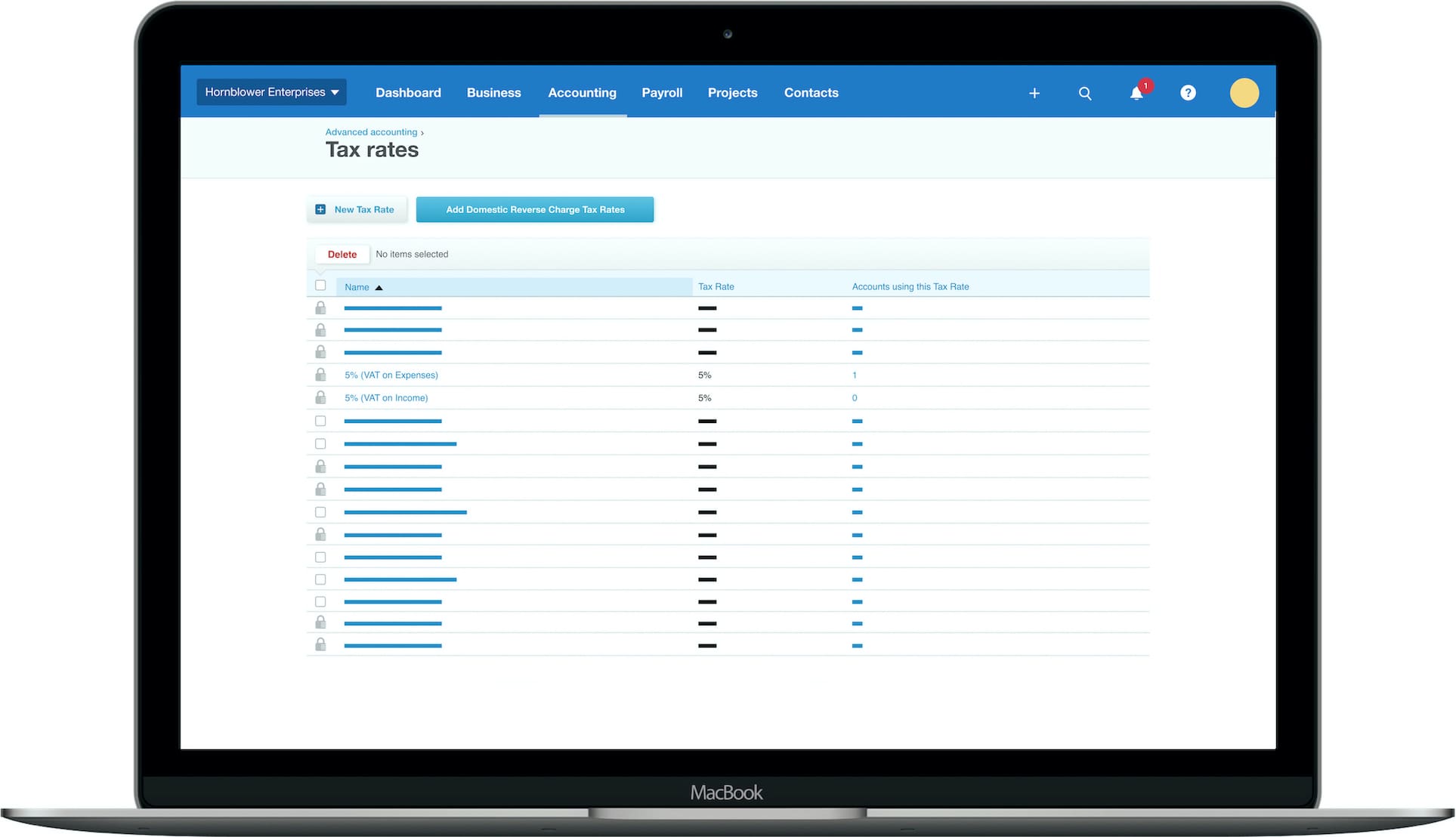

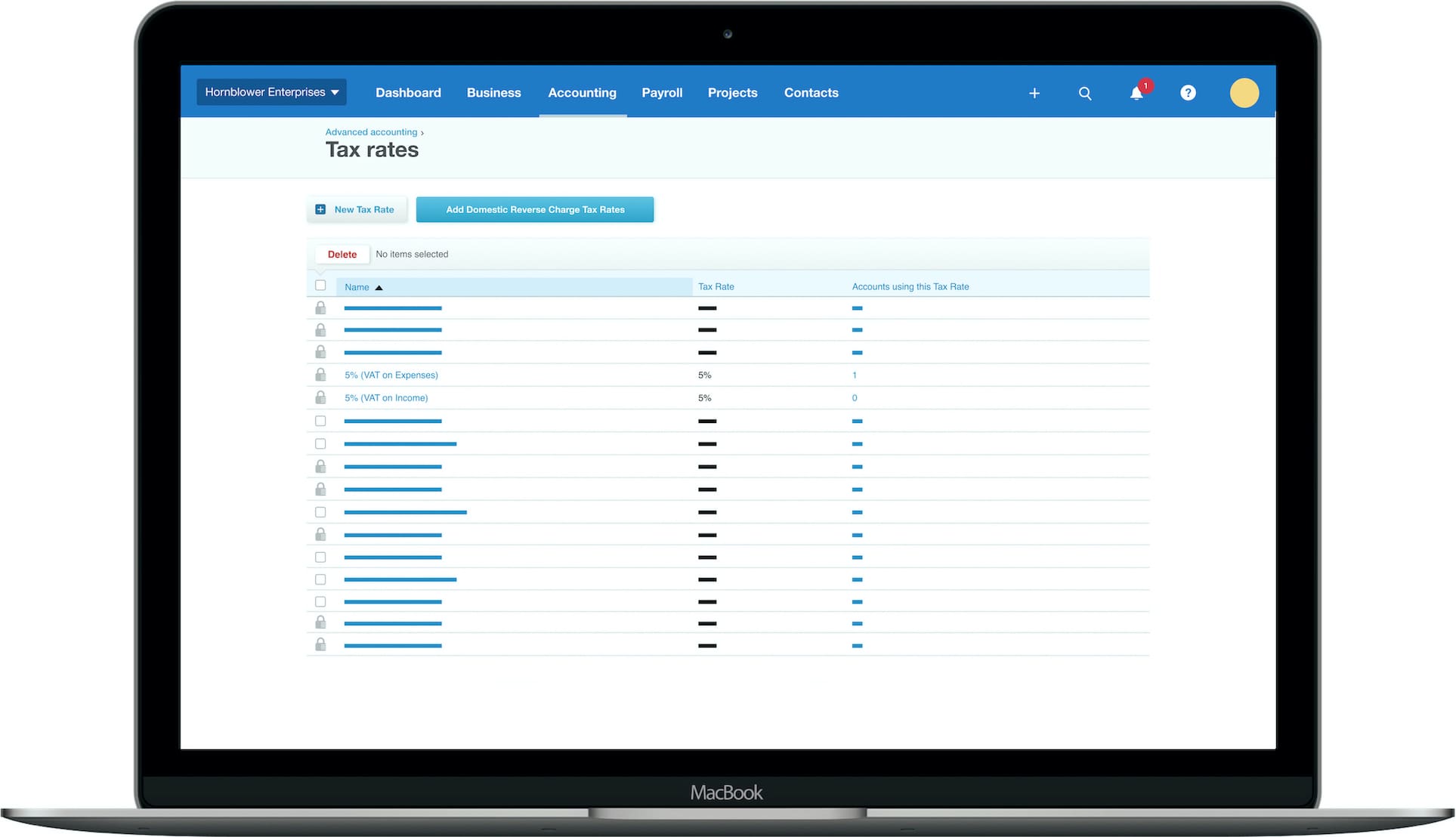

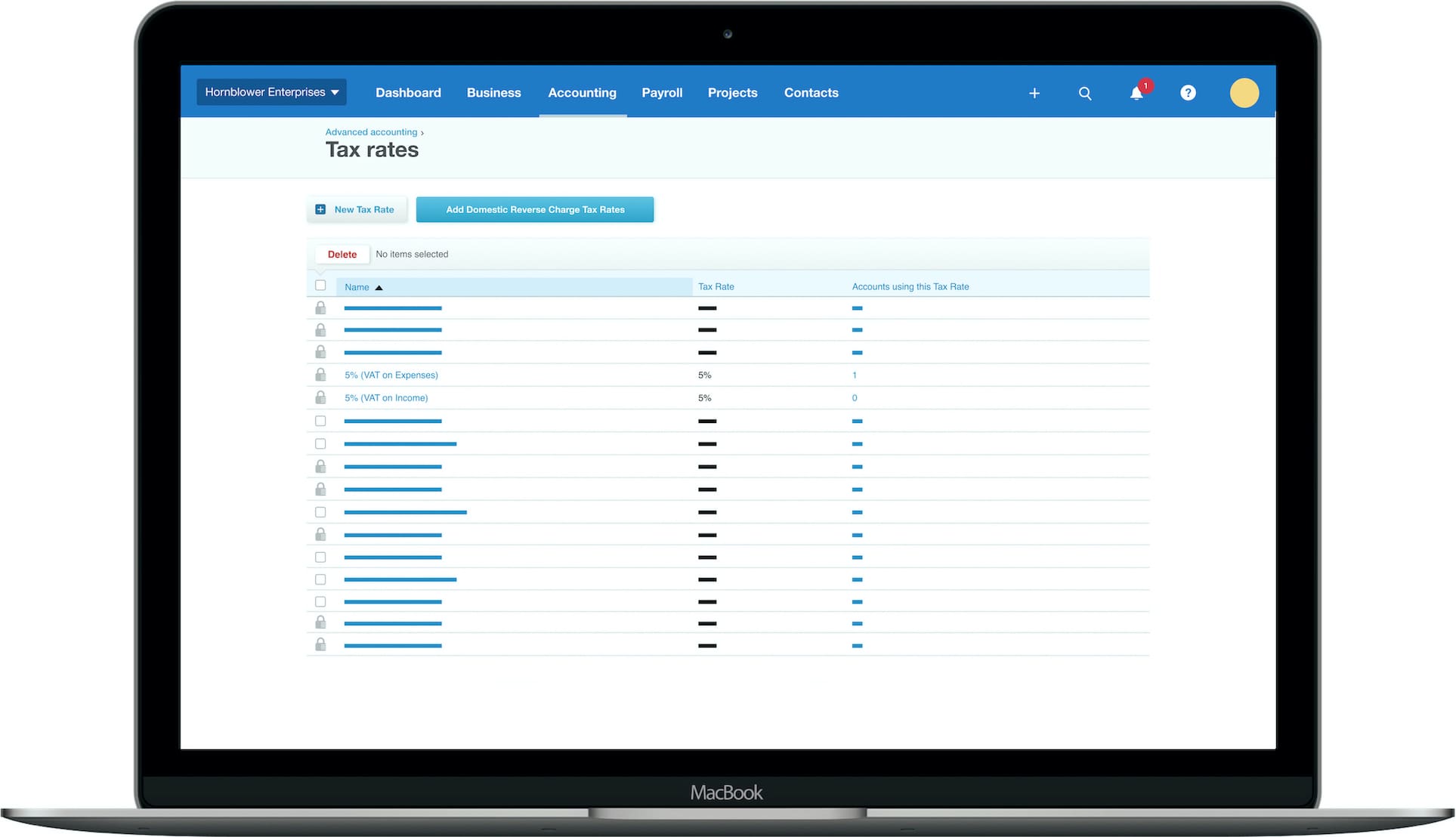

How to apply the VAT cut in Xero

If you do not have a tax rate of 12.5%, you can easily create one. See below, or check out Xero Central for more information on creating VAT rates.

How to set up default VAT rates in Xero

To save you time on applying the reduced 12.5% VAT rate for every transaction, Xero enables you to set up default rates. You may wish to change the following areas:

- Chart of accounts

- Customer and supplier contacts

- Products and services

- Bank rules

- Repeating invoice templates

If you have any questions about which areas you should update, please contact your accountant or Xero support. You can also check out our support article for more information about creating and accessing your cases.

Lastly, if you’re a business using different software products such as hospitality products that integrate with Xero, please check if they’ve got capabilities to deal with reduced VAT sales and purchases.

Visit our dedicated site for more resources, webinars and updates to help you navigate the COVID-19 pandemic.