Knowing that cash flow is important is one thing, but understanding where your business stands and what actions you need to take to improve your cash flow is quite another. We’ve released a number of new features this month that we hope will provide the visibility and insights you need to manage your cash flow during COVID-19.

Better visibility of your performance

Last year, we announced that we were piloting a new Xero feature called business snapshot. It’s a visual dashboard of key financial metrics that helps you see how your business is performing at a glance. Since launching the pilot, we’ve received some really positive feedback from customers who have been testing the feature over the past four months.

Business snapshot displays data in beautiful charts, tables and at-a-glance figures that make it easy to compare profit and loss, turnover, expenses and efficiency between different periods. We know how useful this will be during COVID-19, so we’ve extended the pilot to Xero customers with business edition plans.

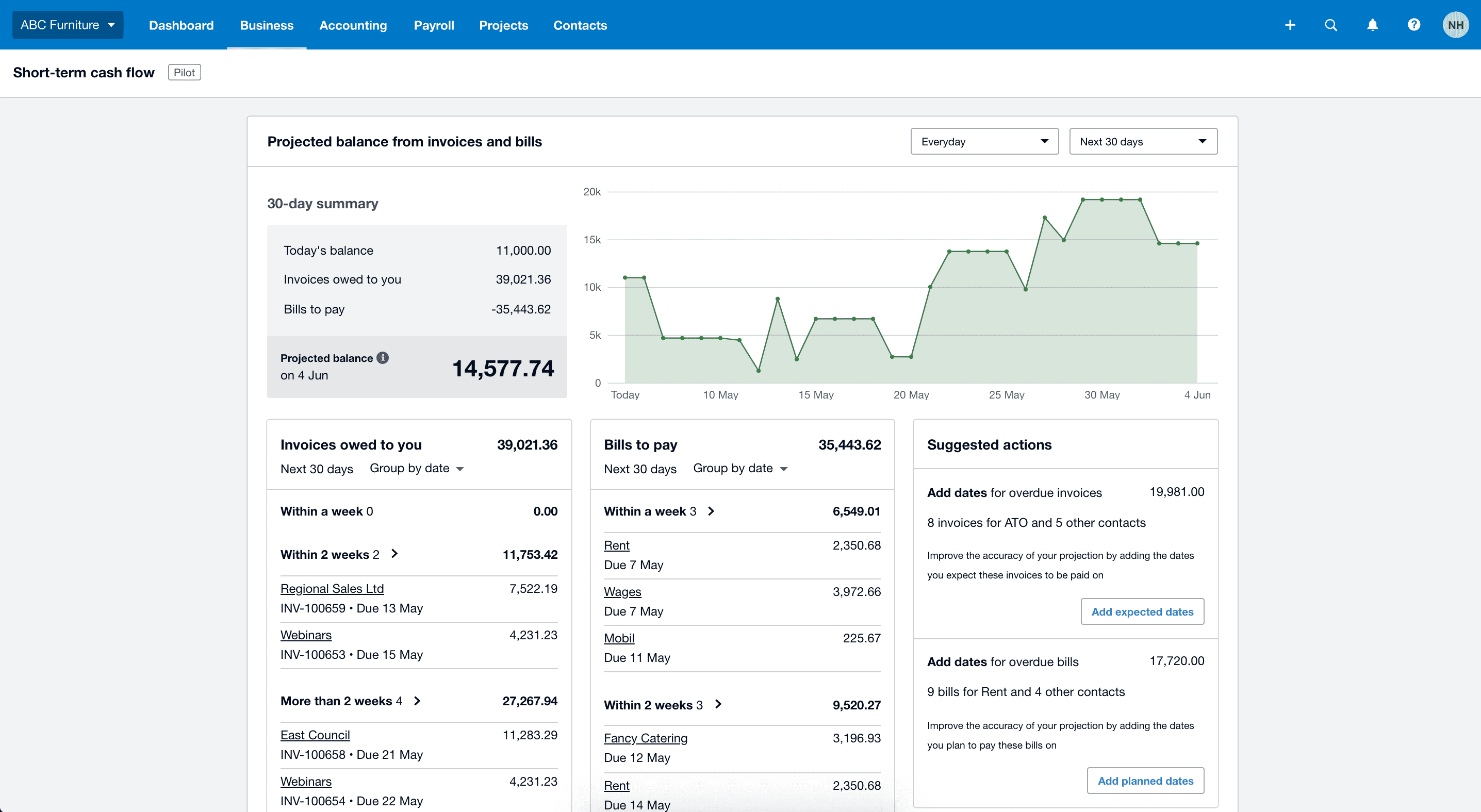

We’re also rolling out the pilot of our short-term cash flow feature to Xero customers with business edition plans over the next two weeks. This feature visually projects your bank balance 30 days into the future, showing you the impact of existing bills and invoices if they’re paid on time. This will help you work out which invoices you should follow up, and see how your cash flow will change if you pay a bill this week versus next week.

Business snapshot and short-term cash flow are both in pilot stage, which means the functionality is quite limited. While our teams are developing the full functionality, we’re providing you with access to the pilot versions until 31 August 2020, so you can manage your cash flow during COVID-19 and start preparing for business recovery.

Quick insights on your clients

Accountants and bookkeepers are playing a vital role in helping clients manage their cash flow during COVID-19. To help you understand which clients need support, we’ve added a COVID-19 support page in Xero HQ, with links to Xero resources and the ability to quickly download a monthly revenue export of client organisations.

The CSV file includes each organisation’s industry, bank (to leverage COVID-19 support available from particular banks), year-on-year monthly revenue, revenue variance, and cash balance. This gives you an opportunity to prioritise your clients in terms of COVID-19 support, and offer them better insights and advice.

Faster payments in Australia and NZ

Another issue that can significantly affect your cash flow is late payments from customers. According to government statistics, small businesses in Australia are collectively owed $26 billion in unpaid invoices at any one time. Of all late payments, over 20% are due to errors on invoices. And of those, over 20% are due to invoices being sent to the wrong customer after manual entry.

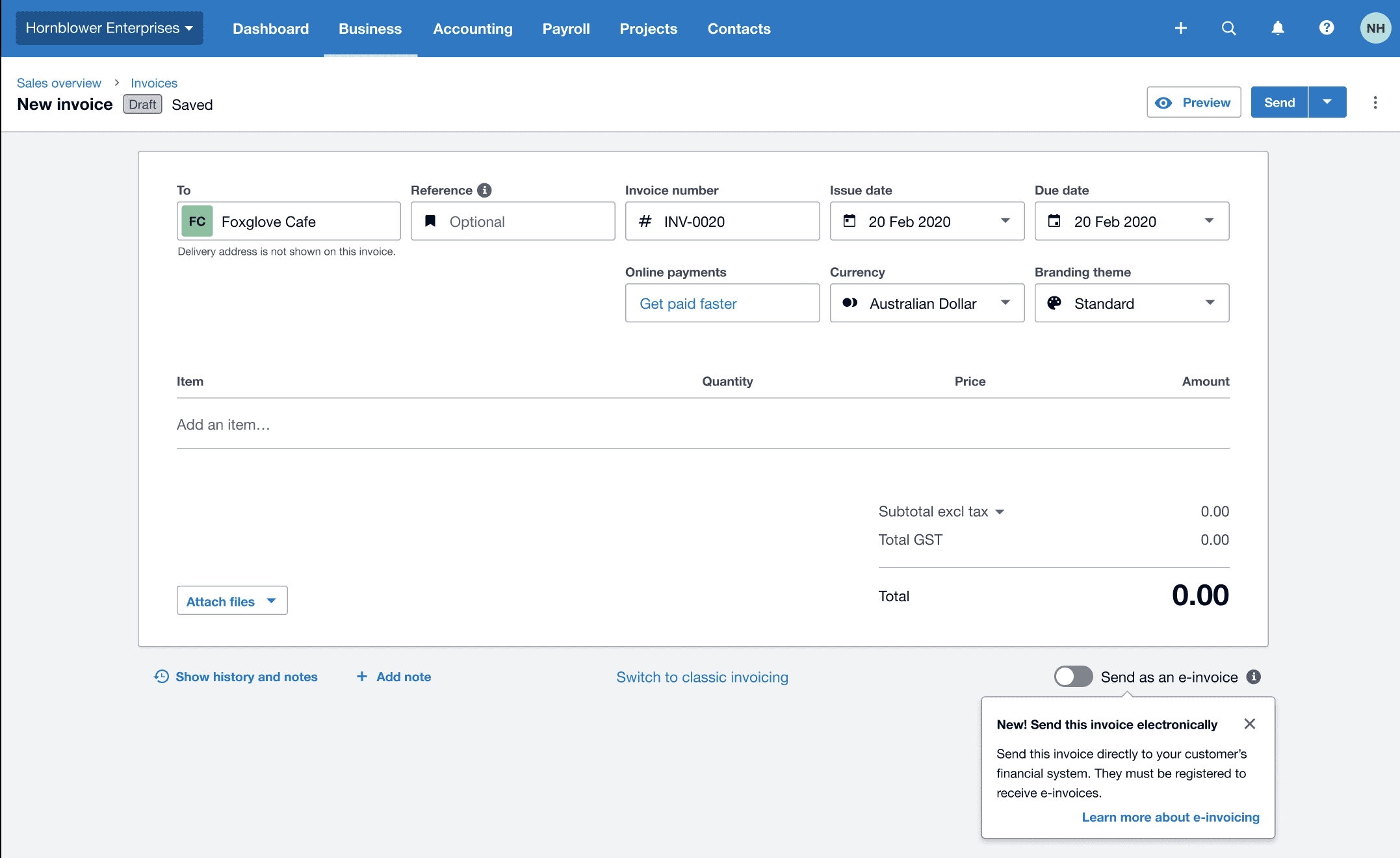

To address this, the Australian and New Zealand Governments are adopting e-invoicing. E-invoicing lets you securely exchange invoices and bills with other businesses and government agencies. Unlike emailing a PDF or online invoice, e-invoices are sent directly from Xero into your customers’ accounting system, where they are automatically pre-populated and can be approved and paid. This means no manual entry and a reduced risk of errors, so you get paid faster.

Xero is the first major provider of small business accounting software to introduce e-invoicing in Australia and New Zealand. From today, you’ll be able to send e-invoices from Xero to participating government agencies in Australia and New Zealand. Both governments have committed to faster payment times to support e-invoicing. In Australia, participating government agencies will pay invoices up to $1 million in as little as five days. New Zealand agencies will pay almost all domestic invoices within 10 days.

If you’re in Australia or New Zealand, now’s the time to find out if your government clients are ready to receive e-invoices. You don’t need to register in Xero to send e-invoices — you’ll just need to make sure your Australian Business Number (ABN) or New Zealand Business Number (NZBN) is in your Xero organisation settings, and your customers’ ABN and NZBN are added to their contact card.

We’ve released the first stage of our e-invoicing solution in Australia and New Zealand to help you make the most of the governments’ faster payment terms during COVID-19. In the meantime, our teams are working hard to bring your more advanced functionality, including the ability to register to receive e-invoices in Xero from suppliers, so you can get even better visibility over your cash flow.

An easier way to pay bills in the UK

Even if you’re not operating the way you used to before COVID-19, you may still have a number of essential bills that you need to pay. To make the experience of creating batch payments easier, we’re releasing a new batch payments experience, which will replace the old batch payment screens. Once it’s released on 27 May 2020, you’ll automatically see the new experience the next time you create a batch payment.

We’ve also introduced a new bill payment feature called Pay with TransferWise. Pay with TransferWise helps you manage and pay multiple bills through Xero in one batch, instead of the time-consuming process of manual payments. This saves you time, cuts down on errors and failed payments, and helps you get an up-to-date view of your cash flow.

Pay with TransferWise is simple and available to existing TransferWise customers – or you can sign up for an account through Xero. Once you’ve submitted the payment details in Xero, they’re sent directly to TransferWise. You then transfer funds from your bank account to your Transferwise account. TransferWise instantly pays your suppliers and the bills are marked as paid in Xero.

You’ll no longer need to download batch payment files and upload to your bank, or spend time adding individual bill payments in your internet banking.

Pay with TransferWise lets you make payments in GBP to any UK bank account. It will be available to all UK customers with a Starter, Standard or Premium subscription from 27 May 2020. You’ll need to create a TransferWise account if you haven’t already got one. When you add Pay with TransferWise to Xero, you can choose a plan to suit the number of bills you pay each month. It’s free until 31 July 2020, with standard pricing from 1 August 2020 (prices in GBP exclude VAT).