He closed his first company due to cashflow issues. Now, he’s a successful entrepreneur thanks to Xero

Launching and running a business is no easy feat. Entrepreneurs wear many hats, and some may not have the training or know-how to manage the financial aspect of their ventures. Founders may overlook accounting lapses and problems, especially when it comes to cashflow. This ends up hurting their businesses in the long run.

Cashflow: A big problem for small businesses

In fact, our data reveals that in 2018, Singaporean small and medium enterprises (SMEs) were owed a whopping total of S$4.146 billion (US$3.05 billion) in late payments.

For Junxian Lee, this statistic used to hit too close to home. He launched his first business when he was a university undergrad, and soon discovered that cash was a problem. As he had not yet established a relationship with suppliers, he would often have to pay them up-front and make up the difference later on. This hampered the business’ cash flow — a situation that eventually forced him to close his first business.

Today, Junxian is a successful serial entrepreneur with many ventures under his belt. The lessons he learned from his early projects came in handy, especially that of always ensuring proper cashflow management.

He used those lessons when he co-founded CashShield, which offers a full-machine automated fraud management solution. But this time, he faced another challenge — that of high margins and long sales cycles. Customers could be a dime a dozen, which meant he had to manage his cashflow for at least six months to a year before securing a client. “Once the client comes in, then it’s high repeat and it’s chunky,” he says.

On top of that, CashShield’s highly sophisticated product meant it had to shoulder heavy research and development costs in the short term.

It took a few years, but Junxian finally got the business’ cashflow management and accounting practices right.

Closing the financial understanding gap

In managing the finances of his latest venture, Moovaz, a technology-driven moving service, Junxian has a greater visibility into the numbers of the business.

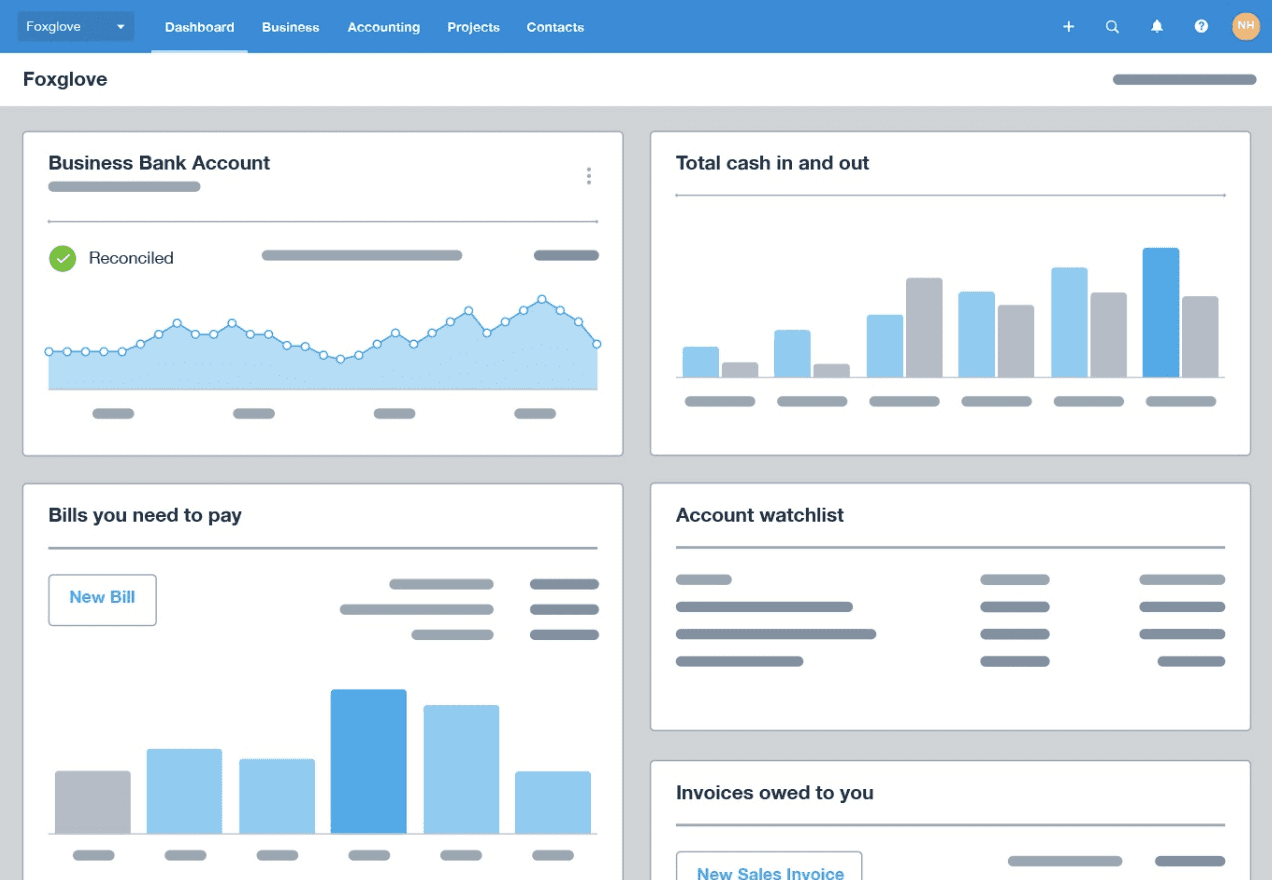

He uses his Xero account daily to keep track of his financial health. It gives him a snapshot of where the business stands every day. With Xero, he creates a monthly overview of the business, including earnings, payments, and pending financial matters. The overview uses the company’s real-time and historical financial data. This information helps him and the company’s management to make crucial data-based decisions, such as whether or not to redirect resources towards certain activities.

This is a far cry from his earlier experiences. He explained, “We knew we were selling. But we just didn’t know what each dollar that we sold meant.” The more they scaled, the more they lost. Despite his background in accounting, he was still spending more money than he was making. He had failed to account for the long-term costs of running a business and how that would affect profit.

He said, “It’s a scenario that I understand all too well from my time as an accountant. I’ve seen startup owners making money without accounting for the ‘slingshot effect’ of expenditure and loss. This included settling bills, collecting payments, and other expenses and tedious accounting tasks. As an accountant, it was my role to take them through their profit and loss. I would help them understand their net profit and what they are left with at the end of the day”.

Xero helps fix this gap in financial understanding among many businesses by connecting them with accounting partners who can improve their financial literacy. These accountants look out for red flags and work with clients on scenario planning.

Not every entrepreneur has a background in accounting though, so business owners would naturally have different approaches to financial management. Reaching out to professionals, such as accountants, can help them make sense of financial position.

Prevent business heartbreaks from cashflow

“You have to know the facts of your or your client’s business — only then can you make strategic decisions or offer suitable solutions. If the facts don’t line up and you don’t have factual content to help people, you’re not going to be successful,” Junxian said.

One of the most interesting things that Junxian shared was that he and his partners undertake ‘sanity checks’. This involves presenting the same hypothetical scenarios and business assumptions to different stakeholders. A partner, for instance, may have one perspective, while an investor might have another. The more accurate forecast tends to lie in the overlap between these different perspectives.

According to Junxian, “To be a responsible business owner, you have to have a hypothesis. And you have to know what this is worth to you and your time. If the numbers based on the hypothesis suggest that a business model won’t work, you might not want to take action on it”.

The same applies to business decisions, especially those that appear to be simple actions but actually end up costing the company significantly. One common example is adding one staff member. Although they factor in the costs and returns of hiring, many startups don’t consider the time they need to invest in training a new person, especially one who might fail to quickly understand the business.

But entrepreneurs sometimes decide to go ahead even if the numbers don’t add up. It’s a risk they’re willing to take because they believe in the mission wholeheartedly. And while such founders generally succeed, it can be heartbreaking when they fail.

To proactively prevent such business heartbreaks, founders can take into account three easy steps:

Gain real-time visibility into accounts

Cashflow is one of the most important indicators of a company’s financial health. Hence, it’s important for entrepreneurs to gain full visibility into what is going on with their accounts. Founders need real-time updates that can be accessed via various devices, and cloud accounting software is one of the greatest tools to achieve this.

Digitise to apply for more working capital faster

Digitising not only makes accounting faster, but also more accurate. This puts businesses in a better position when it comes to proving they are viable for a loan and to secure more capital in a shorter amount of time.

Businesses can streamline the application process by granting lenders (banks and alternative lenders) access to a real-time view of their finances within their cloud accounting platform. This allows them to see the relevant financial information to make a faster credit decision.

Shorten payment cycles drastically

Digital accounting processes have also been proven to accelerate payments for businesses. Our study discovered that SMEs that have gone digital are able to shorten the number of days between invoicing and getting paid. In Singapore, digitisation has helped SMEs cut down their payment cycles from 43 to 30 days.

The business landscape is always changing

The business landscape of Singapore has changed a lot in recent years — but so have the people. Junxian compares the city-state to places like China and San Francisco, where people never expect things to stay the same.

With Singapore’s growing startup ecosystem, more investors are coming in. Access to technology has improved efficiency and sped up the pace of development. Mindsets have shifted, and young people no longer view traditional paths, such as linear careers, as avenues for success. Small business owners have the opportunity to be competitive. Tech companies like Xero, for example, can exist alongside the big boys of finance in the Central Business District.

Meanwhile, the Singapore government keeps pushing the digital boundaries with new regulations that can help businesses — if they know how to take advantage of them. Take the nationwide E-Invoicing network as an example, which is the local extension of the International Peppol E-Delivery Network. It allows businesses to directly transmit invoices in a structured digital format from one finance system to another, resulting in faster payment. Cloud-based accounting software helps businesses keep up seamlessly by integrating these new regulations and other updates automatically into the accounting process. Meanwhile, businesses can also take advantage of grants offered as part of the Accountancy Industry Digital Plan to transform their businesses while lowering their investment.

Cloud-based accounting platforms like Xero can give businesses a much-needed leg up. With a cloud native approach, Xero can help them understand the importance of financial management. It can also offer them the necessary tools to succeed.

Get on the fast track to success with Xero. Sign up for your free trial.