Today we’ve released an Operating Update to the market on our progress over the past year (see further below). This phase of the business is about building out our products, proving our operating models and rapidly growing capacity.

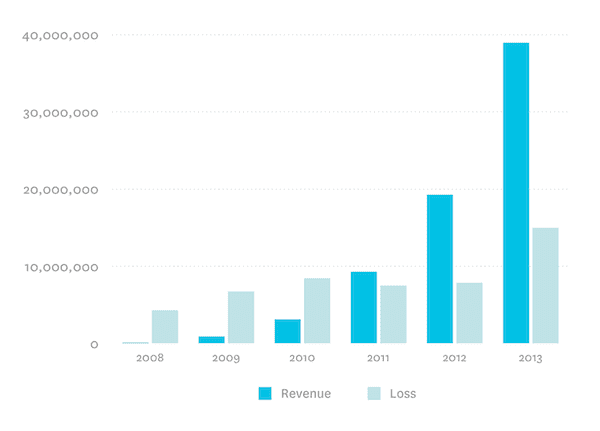

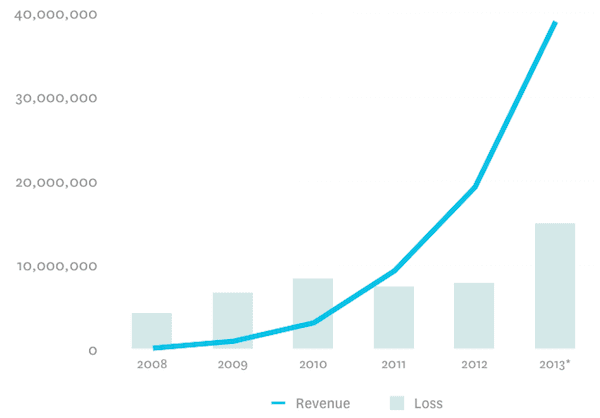

This chart is useful in showing our revenue growth compared to our losses as we invest. You can see clearly that after our capital raising in 2012 we upped our investment to more quickly grow the team so we can continue to deliver rapid growth as we build the foundations for a million paying customers.

The results should give confidence that we’re executing and allows us to continue our substantial investment to deliver the best accounting software in the world, making life easier for millions of small business owners and their advisors. We really love what we’re doing and feel we’re making a positive difference.

It’s been interesting hearing from people watching us closely. We’re getting lots of congratulations and in our home market many people think we’re nearly done. Nothing could be further from reality. We think we’re still at the beginning. Half of all Xeros are in their first year of what we hope will be long Xero careers. We’re thrilled to have quickly grown to over 150,000 customers but that is just a drop in the bucket globally.

We’re fired up, have a ton of stuff in the pipeline and we’re going for it!

Thank you again to our many customers, fantastic partners and patient shareholders who are allowing us to build a great long term business.

Today’s Market Release:

Xero executing to plan

5 April 2013

(Note: all currency is in New Zealand dollars and results are unaudited)

Xero continues to deliver on its high growth strategy, doubling full year revenue to 31 March 2013 to NZ$39m. With Monthly Committed Revenue growing to $4.3m and a recurring revenue model the company commences the 2014 financial year strongly with $51.5m in annualised subscriptions.

The loss for the second half of the year to 31 March 2013 is anticipated to be similar to that reported for the first half resulting in a full year loss less than $15m, up from $7.9m last year.

Key metrics

- Operating Revenue doubled from $19.4m to $39m.

- Annualised Monthly Committed Revenue (MCR) is $51.5m, up from $25.5m at 31 March 2012, or +102% growth.

- Offshore revenue is 62% of Monthly Committed Revenue, up from 51% at 31 March 2012.

- Staff increased from 194 to 382 in the past year.

- Paying customers are at 157,000 at 31 March 2013, up from 78,000 at the same date last year, or +101% growth.

- Cash on hand exceeds $78m.

Commentary

Xero continues to attract global talent adding 188 new jobs in the 2013 financial year to provide additional product development and operating capability, and expanded sales footprint in offshore markets.

A vibrant small business ecosystem has evolved around Xero as it matures into a business platform with over 200 add-on solutions and over 6000 accountants, bookkeepers and trainers working with their customers on Xero.

Over the period Xero continued its significant investment in building professional accountant tools connecting advisors seamlessly to their small business customers. This combined advisor and small business strategy and architecture has disrupted the accountant-side software market in New Zealand and Australia and has been a significant contributor to growth.

In addition to continuous improvements and broadening of the core Xero feature set, new longer-term strategic development projects are progressing well. Expected in calendar 2014 is delivery of US Payroll and Australian Tax features, which will further enhance Xero’s position in those markets.

Regional customer breakdown

Paying customers At 31 March 2013 At 31 March 2012 Year on year change New Zealand 73,000 47,000 +55% Australia 51,000 16,000 +219% United Kingdom 22,000 11,000 +100% United States/Global 11,000 4,000 +175% Total 157,000 78,000 +101% Regional activity

In New Zealand most accountants offer Xero and the focus is on increasing customers per practice. Xero is steadily replacing incumbent providers and seeing strong take-up of its accountant-side software.

Australia has experienced the greatest regional growth during the period and in March overtook New Zealand as the largest regional contributor to revenue. This has followed substantial investment in the Australian team, which has grown from 27 to 71 over the year. A new Australian HQ was opened in Melbourne in December.

In the United Kingdom, tripling the team to 27 over the course of the year also contributed to sustained growth. About a third of the UK’s top 100 accounting firms are now Xero partners.

Xero has established a beachhead in the US market. Product localisations are complete and the foundations of an accountant channel are established. Growth has exceeded that experienced in other markets in their early stages. The US team grew from 19 to 29 in the first 3 months of calendar 2013 with teams in San Francisco, Los Angeles, and Atlanta. A further 14 staff begin employment in April.

Outlook

Xero anticipated the substantial opportunity as small businesses moved to the cloud. It takes a significant investment and many years to build a broad and global small business financial platform. Xero has proven the opportunity, its strategy and its execution ability. The incumbents continue to struggle with the complex transition of their businesses to the cloud model. Xero is now investing in its global sales capability and feels confident in achieving its objective of gaining a million paying customers.